Global Expansion, Local Headwinds: Tax Strategies to Protect Value in 2025

Let’s identify the levers that move your portfolio’s valuation higher, faster.

DATA VISUALIZATION SERIES

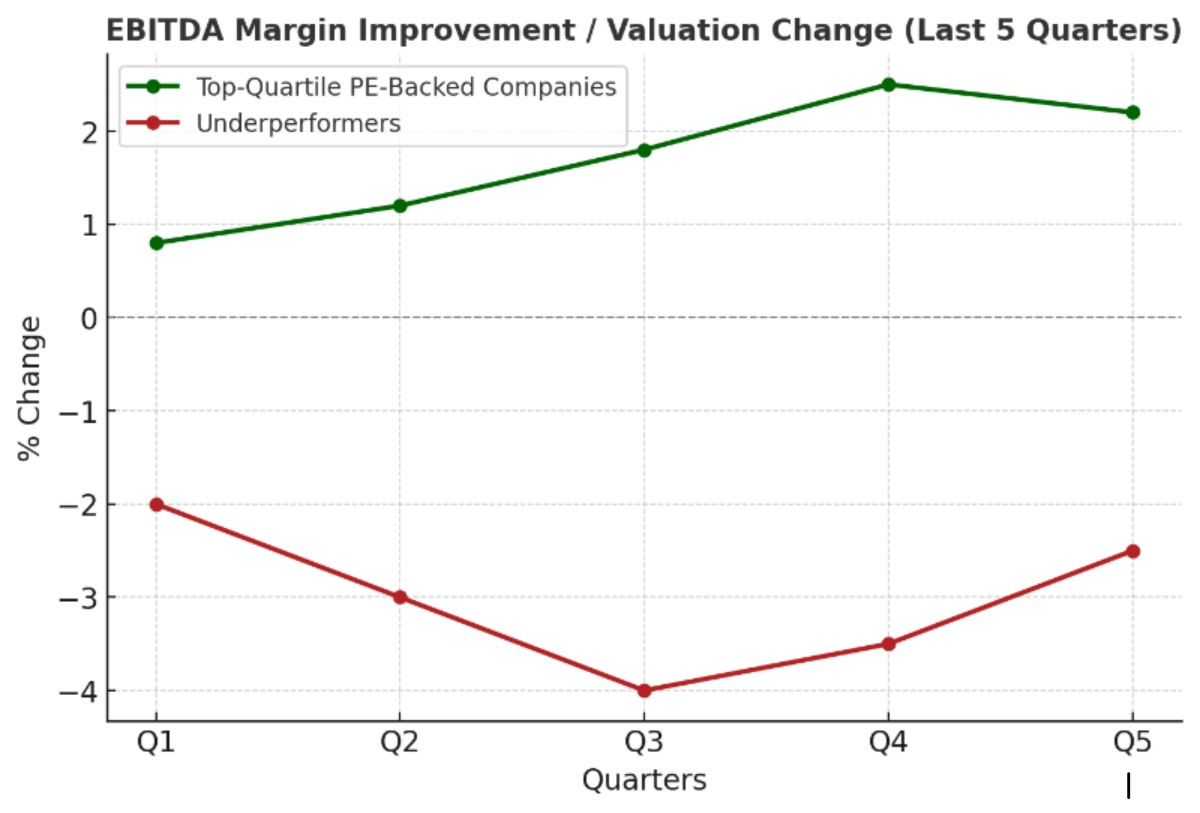

From hundreds of boardroom discussions and portfolio reviews, we’ve identified the signals shaping portfolio value — from capital allocation priorities to operational levers that drive multiples. This is what your peers are tracking to mitigate risk, accelerate returns, and position for premium exits.

2 mins read

2 mins read

2 mins read

2 mins read

2 mins read

2 mins read

CAPABILITY

CAPABILITY

Don’t guess. Test.