The enterprise buying landscape has evolved into a Byzantine maze of interconnected decision-makers, each with distinct priorities, evaluation criteria, and internal political considerations.

The average $25M+ technology implementation now involves stakeholders from Finance, Legal, IT Security, Operations, Compliance, Procurement, and executive leadership, each wielding effective veto power over deal progression.

Modern enterprise purchases cross departmental boundaries, creating coordination challenges that traditional sales processes weren’t designed to handle. A recent McKinsey study found that deals involving 5+ departments take 67% longer to close and have 43% higher failure rates.

Post-2020 regulatory environments have introduced new layers of compliance review, particularly in healthcare, financial services, and government sectors. These requirements aren’t optional add-ons; they’re fundamental gating factors that can derail deals in final approval stages.

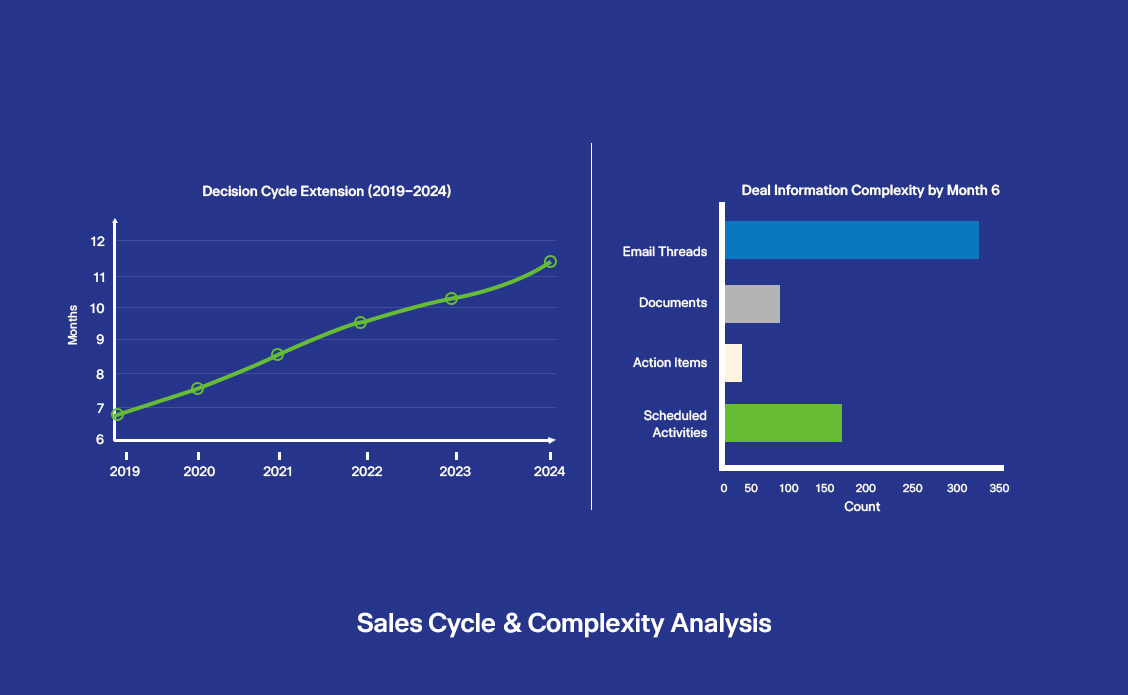

The average B2B purchase cycle has extended from 6.8 months in 2019 to 11.2 months in 2024. This extension isn’t due to deliberation; it’s due to coordination failure across complex stakeholder networks.

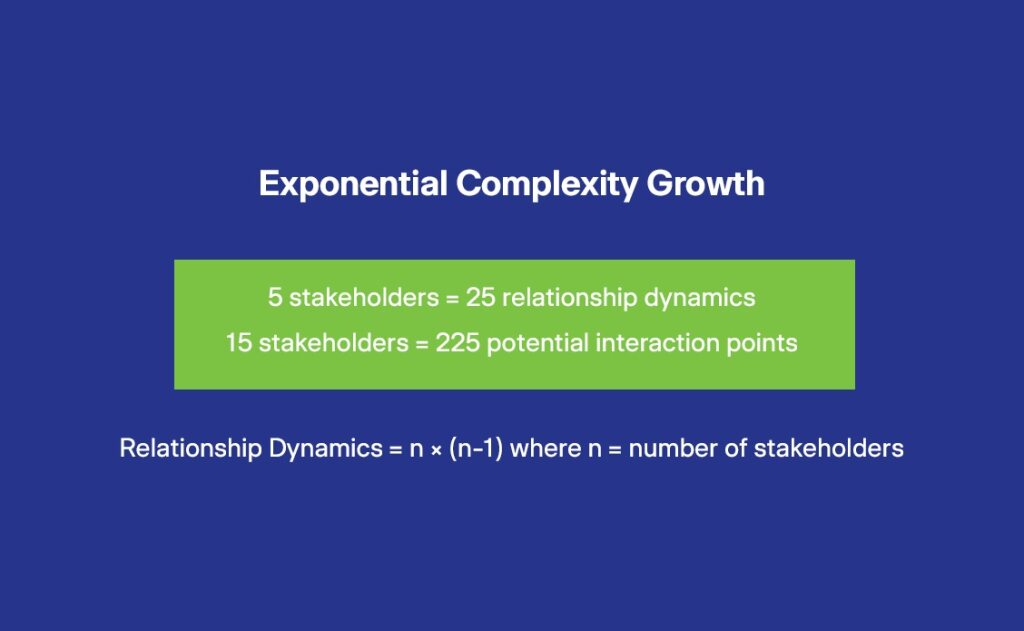

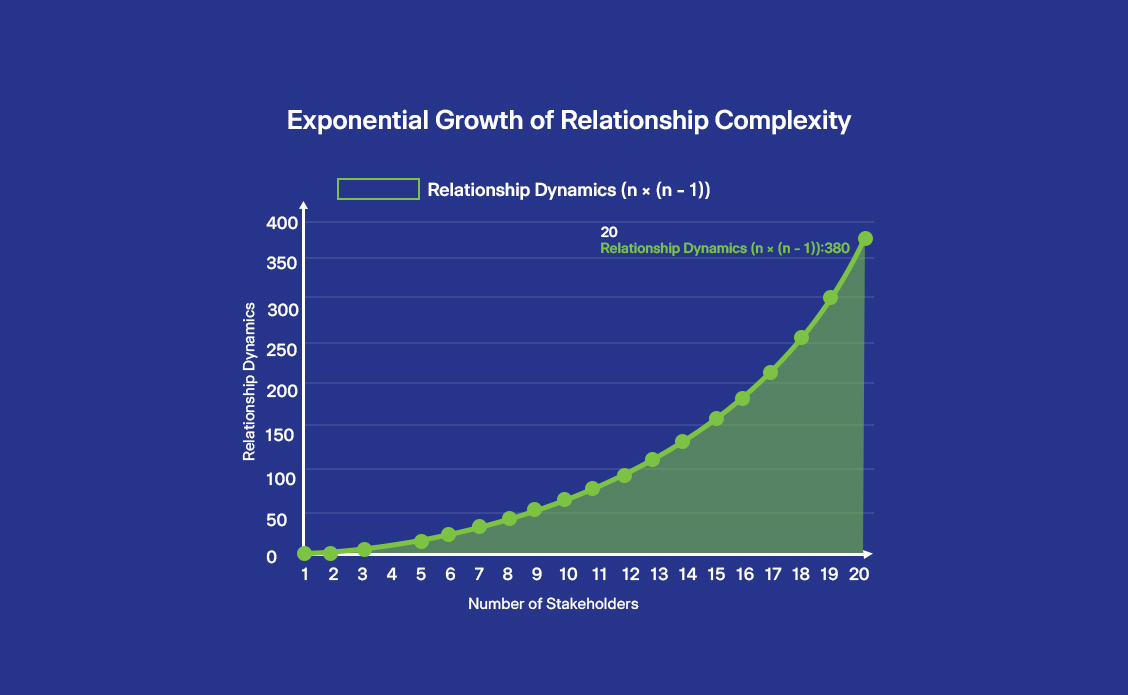

Each additional stakeholder introduces exponential relationship complexity. Five stakeholders create 25 potential relationship dynamics; fifteen stakeholders create 225 interaction points. Without systematic orchestration, these interactions become sources of friction rather than momentum.

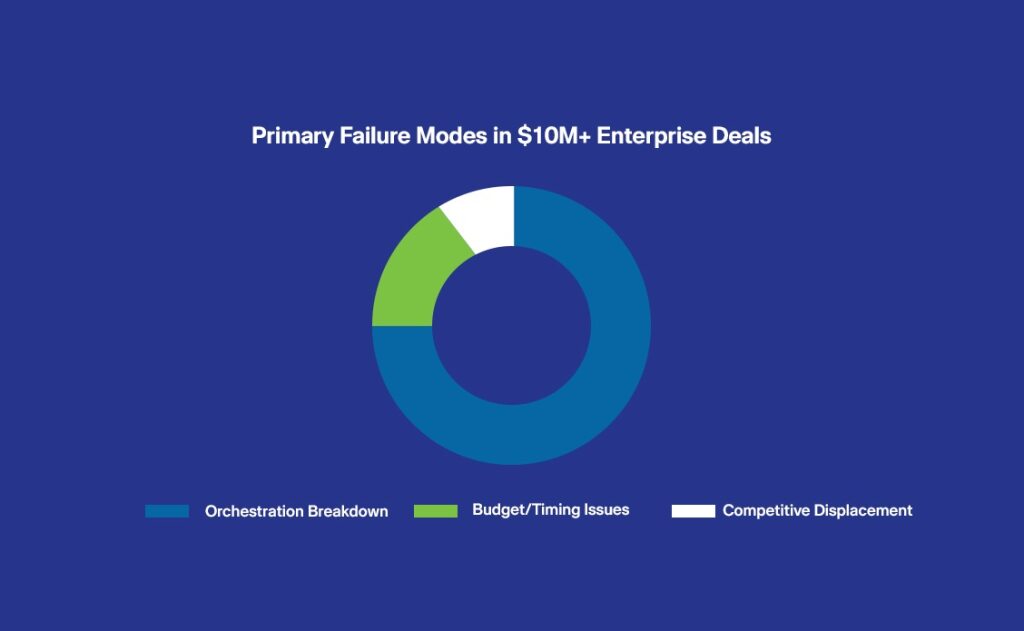

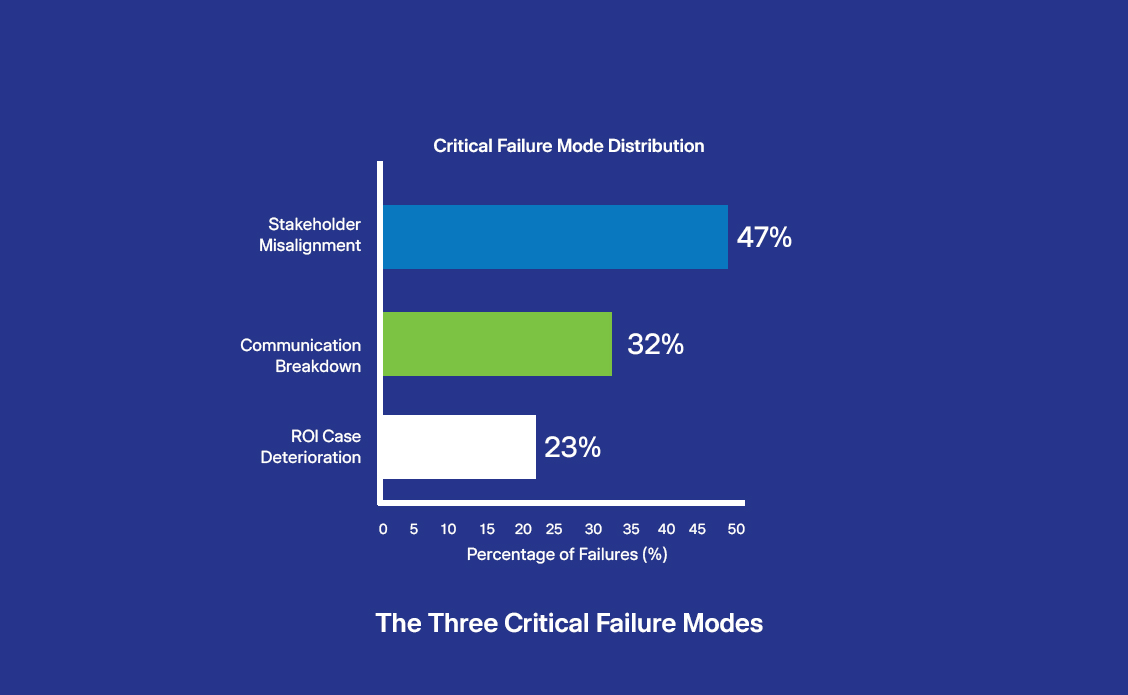

Analysis of failed enterprise deals reveals consistent breakdown patterns that occur regardless of industry, deal size, or vendor capability. Understanding these failure modes is essential for building orchestration frameworks that prevent systematic deal loss.

The Information Entropy Effect: Complex deals generate exponential information complexity. By month 6 of a typical enterprise sale, participants are managing:

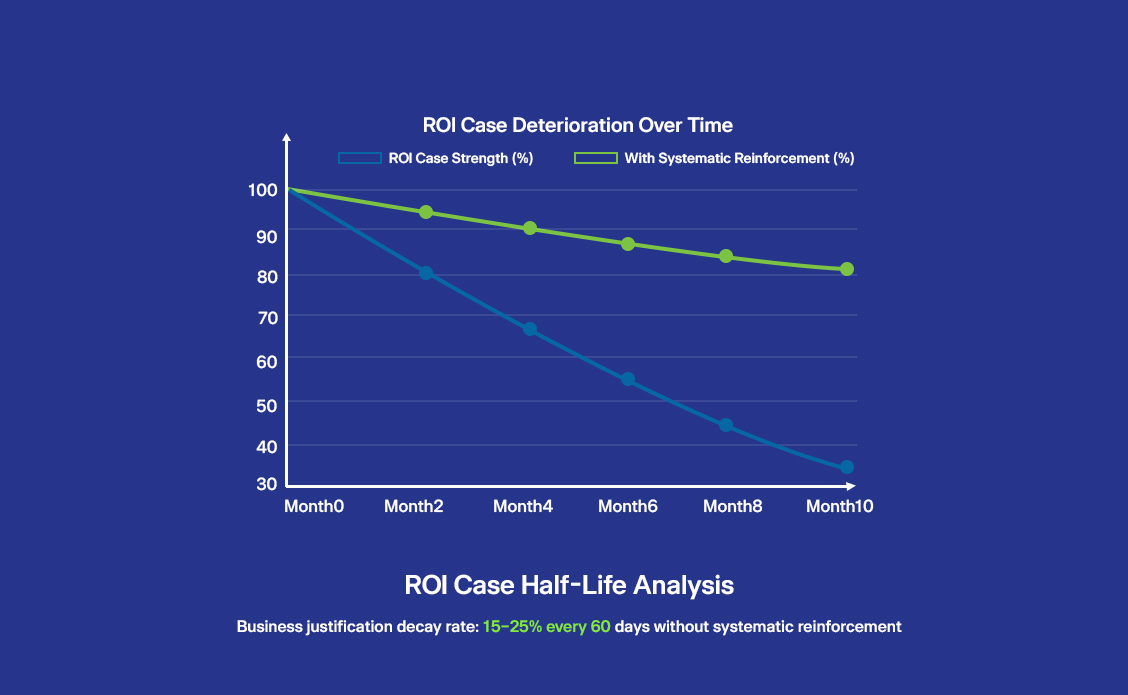

ROI Case Half-Life:

Business justification for enterprise purchases has a measurable decay rate. Without systematic reinforcement, ROI cases lose 15-25% of their compelling power every 60 days (about 2 months) due to changing business conditions and stakeholder turnover.

The highest-performing enterprise sales organizations don’t rely on individual sales rep heroics; they engineer deal success through systematic orchestration frameworks that coordinate complex stakeholder networks, streamline communication flows, and maintain business case momentum throughout extended sales cycles.

Advanced Stakeholder Intelligence:

Implementation Example:

Leading enterprise software companies use stakeholder intelligence platforms that track 47 distinct data points per stakeholder, including engagement patterns, internal influence metrics, and decision-making timeline preferences.

The most successful complex enterprise deal orchestration initiatives establish dedicated cross-functional task forces that mirror the customer’s buying committee structure. These task forces coordinate internal resources, ensure consistent messaging, and maintain deal momentum across all stakeholder touchpoints.

Task Force Composition:

Modern enterprise deals require sophisticated information management systems that go far beyond traditional CRM platforms. Data-driven deal rooms provide centralized collaboration environments where all stakeholders can access relevant information, track decision-making progress, and maintain alignment throughout the sales cycle.

Deal Room Analytics:

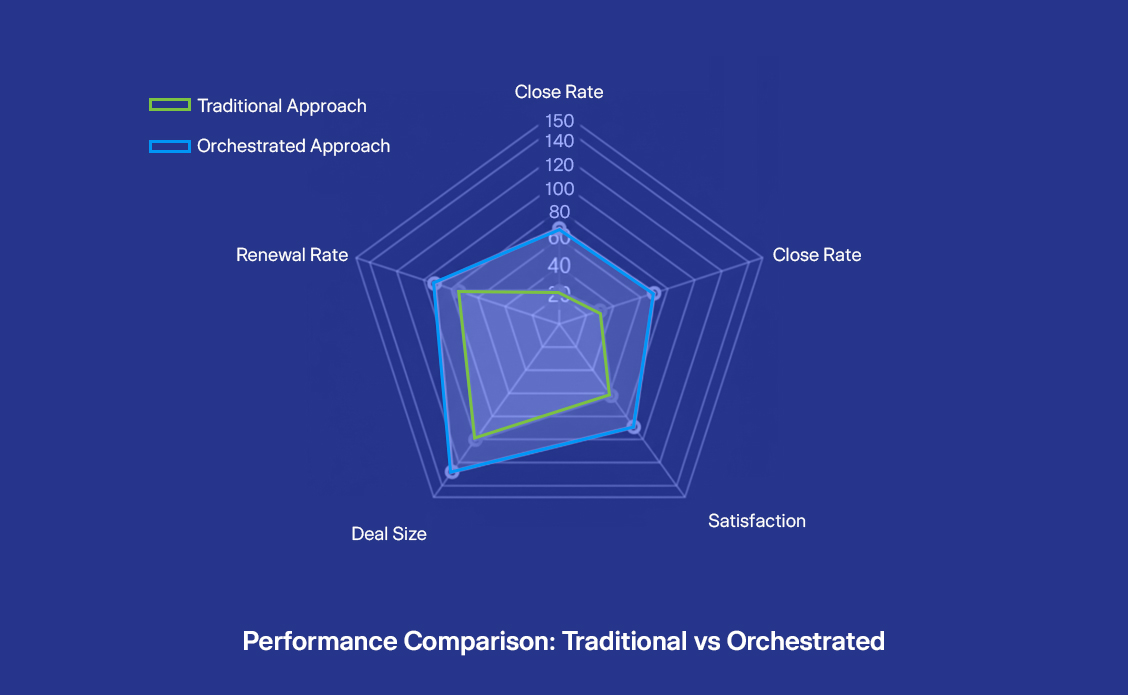

| Metric | Traditional Approach | Orchestrated Approach | Performance Lift |

|---|---|---|---|

| Close Rate (Deals >$10M) | 23% | 67% | +191% |

| Average Sales Cycle | 11.2 months | 7.8 months | -30% |

| Stakeholder Satisfaction | 6.2/10 | 8.9/10 | +44% |

| Deal Size Premium | Baseline | +28% | +28% |

| Renewal Rate | 74% | 92% | +24% |

Don’t guess. Test.