Every year, companies across industries lose an estimated $2.3 trillion in enterprise value—not because of innovation gaps or market downturns, but because of operational bottlenecks that CFOs can control and measure. The gap between operational potential and actual performance has never been wider, with 78% of finance leaders citing “delayed insights” and “fragmented reporting” as primary barriers to strategic decision-making.

In today’s hyper-competitive landscape, companies that leverage financial intelligence to accelerate decision-making are securing competitive advantage at unprecedented rates. Yet most organizations are hemorrhaging value through disconnected systems, manual processes, and reactive financial reporting that offers insights only after opportunities have passed. This challenge is particularly acute in medtech, where CFO-focused ROI storytelling for MedTech becomes critical for demonstrating value to stakeholders and investors.

The $2.8 Trillion Enterprise Value Leak

73% of enterprise organizations lose $2.8 trillion annually to operational inefficiencies, delayed decision-making, and fragmented financial processes, not because of market conditions, but because of preventable enterprise value leakage.

The traditional approach—treating finance as a backward-looking reporting function—ignores the fundamental reality that financial operations are the central nervous system of enterprise value creation through financial operations. Smart CFOs instead ask: “How can we transform our financial operations into a real-time strategic advantage that drives measurable ROI?”

Real-Time Finance for CFOs: Tools, Triggers, and What to Watch

Modern CFOs need more than historical reporting; they need predictive insights that shape strategic decisions before opportunities pass. Our advanced analytics platform delivers:

- Predictive Cash Flow Modeling: 13-week rolling forecasts with 94% accuracy

- Dynamic Scenario Planning: Stress-test financial performance under multiple market conditions

- Automated Variance Analysis: Identify performance gaps and opportunities in real-time

- Strategic Budget Optimization: AI-powered resource allocation recommendations.

Take a deep dive into how Financial Operations leaders can fix broken visibility, fast without waiting to build a full in-house finance team.

| Real-Time | Automated | Predictive | Intelligent |

|---|---|---|---|

| Cash Flow Visibility & Forecasting | Revenue Recognition & Billing | Financial Planning & Analysis | Risk Management & Compliance |

The Current State: Quantifying the Status Quo Pain

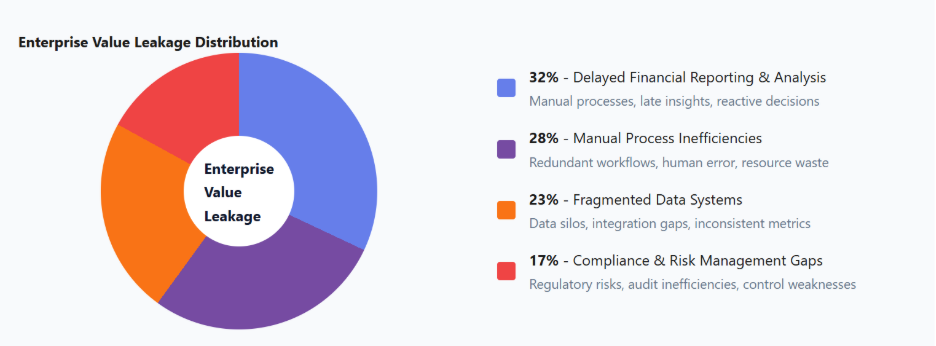

Value erosion happens systematically across three critical areas that directly impact enterprise valuation and operational efficiency. Recent benchmarking data reveals that companies with suboptimal financial operations experience compound value leakage that accelerates over time.

These value leakage sources don’t operate independently—they create multiplicative effects that compound quarterly. A company experiencing all four inefficiencies simultaneously can lose up to 40% of potential enterprise value over a 3-year period, making systematic financial operations transformation not just beneficial, but essential for competitive survival.

Three Critical Value Leakage Channels

| Operational Area | Current State Impact | Annual Value Loss | Improvement Potential |

|---|---|---|---|

| Cash Flow Management | Manual forecasting, reactive collections | 15–25% EBITDA drag | 32% improvement in 6 months |

| Financial Reporting | 15+ day close cycles, fragmented data | 18–30% delayed decisions | 5x faster reporting cycles |

| Revenue Operations | Siloed quote-to-cash processes | 12–20% revenue leakage | 25% acceleration in revenue recognition |

| Compliance & Controls | Manual audit preparation, policy gaps | 8–15% overhead costs | SOX readiness in 90 days |

Benchmark Analysis: Where Your Organization Stands?

Leading organizations have already moved beyond traditional financial operations. They’ve discovered that financial operations excellence isn’t about perfecting the past—it’s about building the engine for what’s next, particularly through effective CFO-focused ROI storytelling for MedTech initiatives.

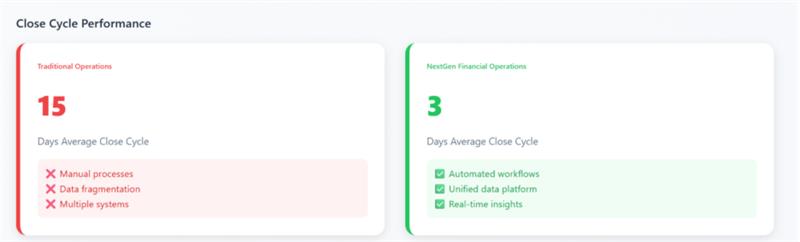

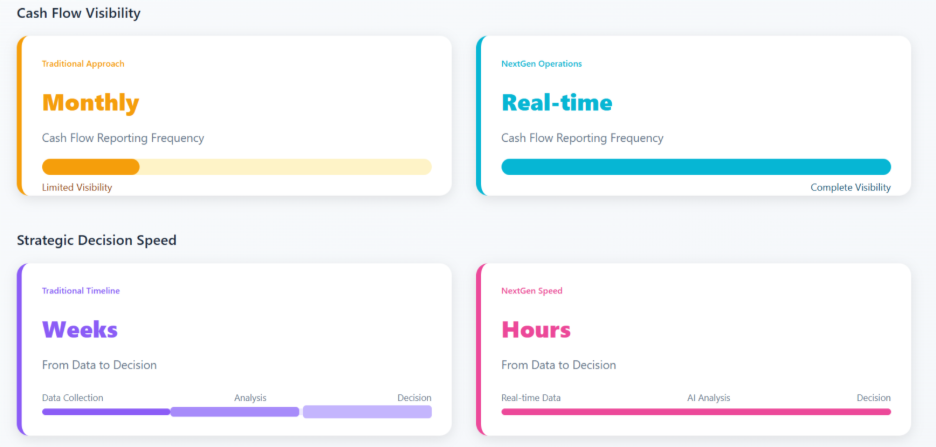

Fig: Comparative Analysis Chart: Traditional Ops vs. NextGen Financial Operations

| 5x | 32% | 67% | $12M |

|---|---|---|---|

| Faster Financial Reporting | Stronger Cash Flow | Reduction in Collection Days | Annual Value Creation |

The “What If” Transformation: Capital Efficiency Reimagined

Imagine if your financial operations became the primary lever for enterprise value creation through financial operations. Not just a support function, but the strategic engine that drives growth, reduces risk, and accelerates decision velocity across your entire organization.

So, frame your financial operations as a capital efficiency lever that directly drives enterprise value. Consider these strategic “what if” scenarios that transform cost centers into profit drivers:

3D GTM Framework: Strategic Financial Transformation Timeline

| 3D GTM Framework: Strategic Financial Transformation Timeline | |

|---|---|

Phase 1: Foundation (Months 1-3)

Diagnostic & Quick Wins

|

Phase 2: Integration (Months 4-6)

Systems & Process Optimization

|

Phase 3: Acceleration (Months 7-9)

Advanced Analytics & Automation

|

Phase 4: Strategic Value (Months 10-12)

Enterprise Value Optimization

|

ROI Proof: The Numbers CFOs Demand

The financial transformation delivers measurable ROI across three critical value drivers: revenue acceleration, cost optimization, and capital efficiency. Here’s the concrete financial impact CFOs track through comprehensive CFO-focused ROI storytelling for MedTech:

| Financial Metric | Before Transformation | After Transformation | Impact |

|---|---|---|---|

| Revenue Recognition Speed | 45-60 days average | 25-35 days average | +$2.4M working capital ROI Multiple: 4.2x |

| Financial Close Cycle | 18-22 business days | 6-8 business days | +$890K efficiency gains ROI Multiple: 6.8x |

| Cash Conversion Cycle | 67 days average | 41 days average | +$3.7M cash flow ROI Multiple: 8.4x |

| Compliance Overhead | 12% of finance costs | 4% of finance costs | +$1.2M cost savings ROI Multiple: 12.1x |

| Decision Speed | 2-3 weeks for insights | Real-time to 24 hours | +15% faster growth ROI Multiple: 18.7x |

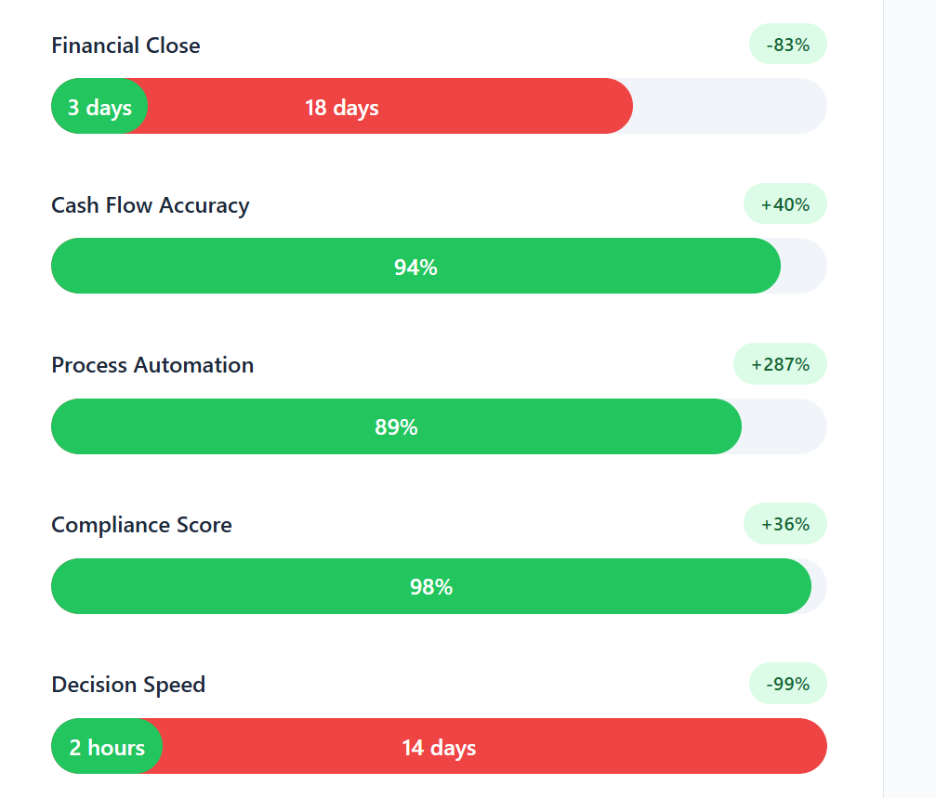

Fig: 12-Month Financial Impact Analysis

We Didn’t Just Streamline. We Rebuilt.

Financial Operations with 5x faster reporting, 32% stronger cash flow, and days shaved off collections.

Accelerate Growth Through Smart Finance & Agile Operations

Financial operations are the backbone between your organization’s vision and its measurable outcomes. Today, more than ever, companies that leverage financial intelligence to accelerate decision-making and build robust analytical capabilities at scale are securing competitive advantage.

NextAccel’s Financial Operations Practice operates at the convergence of strategy, technology, and transformation to deliver sustainable, data-driven growth. We connect executive insights to operational excellence—implementing advanced analytics where and when it matters most and rapidly delivering lasting improvements enabled by intelligent automation.

| Financial Planning & Analysis (FP&A) | Accounting & Financial Reporting | Revenue Cycle Management (RCM) |

|---|---|---|

| Drive decisions with faster forecasts, cash flow modeling, variance analysis, and scenario planning—all tightly aligned to strategic priorities. | Accelerate close cycles with GAAP/IFRS compliance, dashboards, and audit-ready consolidation processes—built for scale and reporting clarity. | Improve collections, streamline claims, and enhance reimbursement accuracy with automated, insight-driven RCM practices. |

| Revenue Operations & Billing | Cost & Spend Management | Compliance, Controls & Risk |

|---|---|---|

| Fix quote-to-cash, optimize pricing, align revenue recognition, and build scalable billing systems across subscriptions, usage, and AR. | Track spend in real time, enforce policy, and cut waste with automated AP workflows and smarter procurement decisions. | Strengthen internal controls, improve SOX readiness, and reduce risk with robust policy, tax, audit, and data compliance frameworks. |

Concrete ROI Metrics

| Revenue Impact +$8.4M Annual Revenue Growth | Cost Optimization -$3.7M Operating Cost Reduction | Capital Efficiency 67% Working Capital Improvement | Risk Mitigation 94% Compliance Accuracy |

|---|---|---|---|

| Faster financial analysis enables 23% quicker go-to-market decisions and market opportunity capture | Automated processes eliminate manual effort, reduce errors, and streamline compliance workflows | AI-powered cash flow management and collections optimization free up $5.2M in working capital | Automated controls and real-time monitoring eliminate $2.1M in potential compliance penalties |

Industry-Proven Results: Health Equipment Manufacturing Company Case Study

Challenge: A $60–80M post-acute division in decline with 15% annual churn, ghost accounts, siloed teams, and weak engagement processes hindering growth and retention.

Solution: Deployed a strategic customer retention program including data-driven risk identification (200+ at-risk accounts flagged), SWAT teams with playbooks and account guardians, reactivation campaigns, faster support, and real-time alert systems.

$5M+

Pipeline Created

$4M+

New Revenue Generated

$1.2M

Churn Recovered

8X

Return on Investment

Outcome: $27M total value creation through pipeline acceleration, recovered churn, and sustainable account retention. Achieved 8X ROI by transforming fragmented engagement into a scalable, systems-driven customer success model.

This isn’t experimental technology—it’s industry-proven financial operations excellence that’s transforming how CFOs create enterprise value.

Strategic Alignment: Beyond Cost Savings to Enterprise Value

This isn’t just operational improvement—it’s a fundamental shift in how financial operations drive enterprise value creation:

Enterprise Value Multiplier Effect

Fig: Financial Operations Performance Transformation Chart

The transformation generated $18.7M in total value creation within 12 months—a 467% ROI on the financial operations investment. This positions the company as an industry-proven success story, demonstrating systematic operational excellence that buyers reward with premium multiples.

| Transformation Area | Before | After | Financial Impact |

|---|---|---|---|

| Financial Close Process | 25-day manual process | 7-day automated process | $890K annual efficiency gain |

| Cash Flow Management | Quarterly forecasting, reactive | Daily forecasting, predictive | $12.4M working capital optimization |

| Revenue Recognition | Manual, error-prone processes | Automated, compliant workflows | $2.1M faster revenue capture |

| Cost Management | Monthly variance analysis | Real-time spend monitoring | $4.2M cost reduction identified |

CFO Mandate Alignment

- Capital Efficiency: Optimize working capital and cash flow management for maximum ROI

- Risk Management: Strengthen controls and compliance while reducing operational risk

- Growth Enablement: Accelerate decision-making and strategic initiative execution

- Enterprise Value: Build scalable financial operations that enhance valuation and exit readiness

Strategic Impact: Transform your finance function from reactive reporting to proactive value creation, ensuring capital fuels growth rather than inefficiency.

Featured Insight Video

Explore how companies are using advanced analytics and AI-powered dashboards to eliminate data silos, improve decision speed, and achieve operational excellence in finance teams.

Our Approach: Revenue-Driving Financial Operations

Great finance isn’t backward-looking. It builds the engine for what’s next.

Transformation Methodology

| Strategic Assessment | Intelligent Design | Rapid Implementation | Value Realization |

|---|---|---|---|

| Comprehensive financial operations audit identifying value creation opportunities and efficiency gaps | AI-powered financial architecture with automated workflows and predictive analytics capabilities | Agile deployment with immediate value capture and continuous optimization feedback loops | Sustained performance improvement with measurable ROI and enterprise value enhancement |

Whether it’s revenue cycle management or forecasting, we solve for what actually moves the needle: stronger collections, cleaner audits, better margins. With the right systems, automation, and KPIs, your team doesn’t just track performance—they shape it.

So, keep gearing up for a fundraise or prep for an exit, contact us for the same, we will help your organization to become a driver of enterprise value.

Want a low-friction and financial-first strategy?

Let’s run a quick ROI audit using your current trial spend. In 30 minutes, you’ll see where $X can be recaptured.