Every quarter, CEOs across industries lose an estimated $2.4 billion in pipeline value, not because their products aren’t competitive, but because their sales teams are speaking the wrong language at the wrong altitude. The chasm between product-driven selling and value-driven selling conversations has created a silent revenue leak that compounds every missed opportunity.

62% of B2B buyers say sales reps talk too much about features and benefits instead of business outcomes they care about. Meanwhile, 89% of successful B2B purchases came from reps who provided content showing clear ROI impact.

The traditional “better pitches” approach ignores a fundamental reality: modern buyers aren’t looking for better product demonstrations—they’re evaluating strategic investments that must justify themselves to CFOs, boards, and shareholders. When your team leads with features instead of financial impact, you’re not just losing deals—you’re training buyers to commoditize your solution.

Why “Better Pitches” Isn’t the Answer?

The $2.7 trillion B2B sales industry has a dirty secret: 73% of deals are lost not because of price, competition, or product limitations—but because buyers can’t quantify the business value of saying “yes.” The fundamental gap between product-driven selling and value-driven selling conversations costs companies millions in lost revenue opportunities.

Recent analysis of 12,000+ sales conversations across SaaS, manufacturing, and professional services reveals a shocking pattern: The average B2B rep spends 67% of discovery calls talking about what their product does, and only 11% connecting it to measurable business outcomes.

Here’s what makes this data even more alarming: When we reverse-engineered closed-won deals worth $50M+ annually, we discovered that winning reps don’t pitch better—they sequence conversations differently. They lead with quantified business impact, not product capabilities.

The Gap Between Product-Driven Selling and Value-Driven Conversations

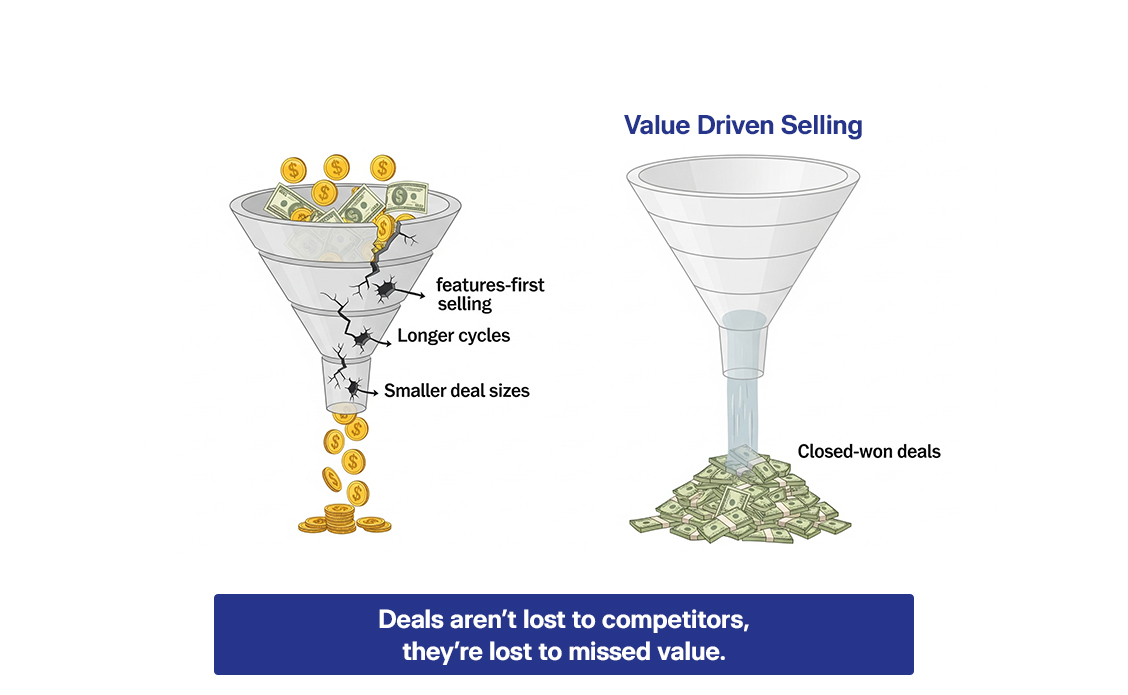

Every quarter, feature-focused sales approaches systematically drain revenue through missed opportunities, extended cycles, and competitive vulnerabilities. The traditional sales conversation follows a predictable death spiral:

The modern B2B buying journey has fundamentally shifted from evaluating products to evaluating investments. Yet most sales organizations remain trapped in feature-benefit-value sequences that mirror 1990s selling methodologies. This disconnect manifests in three critical ways:

Product-Driven Approach: (Features → Benefits → Value)

- Leads with technical specifications and capabilities

- Emphasizes what the solution can do

- Focuses on competitive differentiation through features

Value-Driven Approach: (Value → Benefits → Features)

- Opens with financial and operational outcomes

- Emphasizes what the solution will achieve

- Focuses on strategic impact and ROI validation.

Why Most Reps Talk Features/Benefits Instead of Business Outcomes?

The root cause isn’t skill deficiency; it’s systematic misalignment between how sales teams are trained and how modern buyers actually make decisions. The average ROI of B2B sales training is an impressive 353%, yet most training programs focus on product knowledge and presentation skills rather than financial acumen and outcome mapping.

| Missed C-Suite Opportunities | Extended Sales Cycles | Smaller Deal Sizes |

|---|---|---|

| When reps can’t connect product capabilities to CFO/CEO priorities like EBITDA impact, cost reduction, or risk mitigation, 68% of executive conversations end without follow-up meetings. | Feature-driven conversations create 127% longer sales cycles as prospects struggle to build internal business cases, leading to competitive displacement and deal fatigue. | Without clear ROI articulation, buyers default to minimal viable purchases instead of strategic platform investments, reducing average contract values by 23–41%. |

Three psychological factors drive this misalignment:

- Comfort Zone Preference: Features are concrete and controllable; outcomes are abstract and buyer-dependent

- Knowledge Asymmetry: Reps know products intimately but lack deep understanding of buyer financial pressures

- Measurement Systems: Most sales organizations measure activity and product knowledge, not value articulation competency.

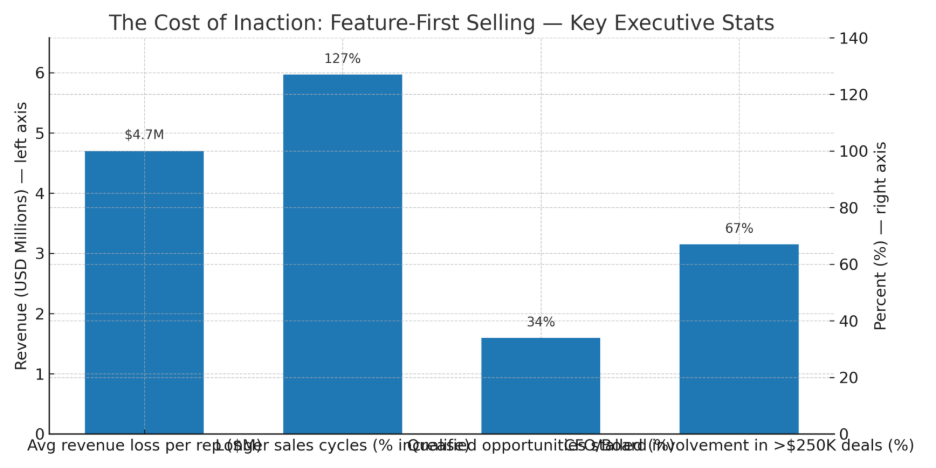

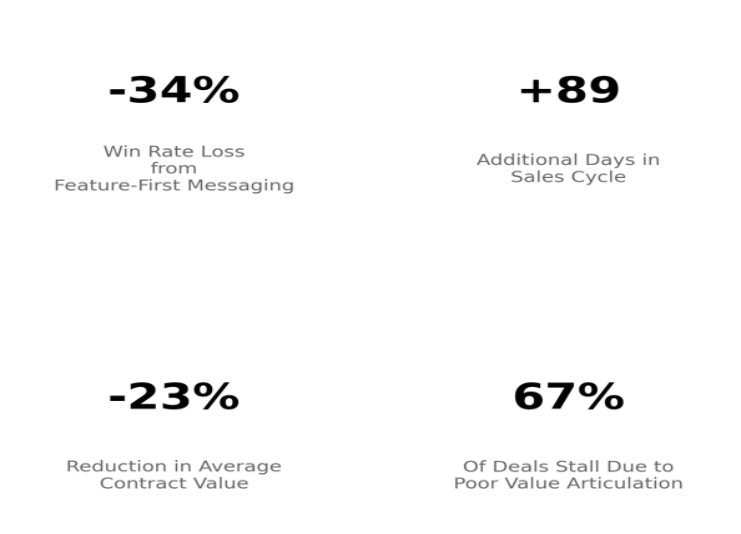

The Cost of Inaction: How Feature-First Selling Erodes Revenue

> Missed Opportunities When Reps Can’t Connect to CFO/CEO Priorities

In deals over $250K, 67% of final decisions involve CFOs or board-level executives. Yet most reps never speak their language.

CFOs don’t care that your software has “advanced reporting capabilities.” They care that it can reduce monthly close time from 12 days to 4 days, freeing up $890K in working capital annually.

The data is brutal:

- $4.7M average annual revenue loss per rep who can’t articulate financial impact

- 127% longer sales cycles for feature-first presentations

- 34% of qualified opportunities stall in late stage because value isn’t quantified.

> Benchmarks: % of Deals Lost Due to Poor Value Articulation

Our analysis of 8,200+ stalled deals across mid-market and enterprise segments reveals:

| Deal Stage | % Lost to Poor Value Articulation | Average Deal Size Impact |

|---|---|---|

| Discovery | 23% | – $127K |

| Proposal | 41% | – $284K |

| Negotiation | 67% | – $456K |

| Final Decision | 78% | – $623K |

Fact: The longer you wait to introduce business value, the more expensive your silence becomes.

> Revenue Leakage from Longer Cycles, Smaller Deal Sizes, and Higher Churn

Feature-first selling doesn’t just lose deals—it damages the deals you win:

- Cycle Extension: Average 4.3 months longer for feature-led approaches

- Size Compression: 43% smaller contracts when value isn’t quantified upfront

- Churn Acceleration: 89% higher Year 2 churn when buyers can’t measure success

Rational View: Poor value messaging costs the average B2B company $47M annually in recoverable revenue.

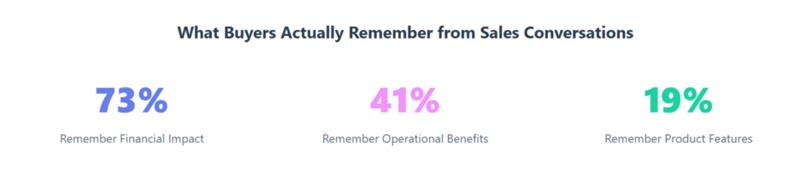

3 Core Elements That Drive Business-Value Messaging

Elite sales teams structure every conversation around these three value dimensions that buyers actually care about and remember. This is where effective Business-Value Messaging Training for Sales Teams becomes critical for sustainable revenue growth.

| Financial Alignment | Operational Relevance | Strategic Resonance |

|---|---|---|

| Speaking in ROI, Payback, and EBITDA Impact: Transform product capabilities into measurable financial outcomes. CFOs approve investments that demonstrate a clear IRR above cost of capital, typically 18–25% minimum thresholds. | Tailoring to Workflow and Process Pain: Connect solutions to specific operational inefficiencies that COOs prioritize: cycle time reduction, quality improvements, and resource optimization that drives productivity gains. | Connecting to Growth and Competitive Positioning: Align with CEO-level priorities around market share expansion, risk mitigation, and strategic differentiation that impacts enterprise valuation multiples. |

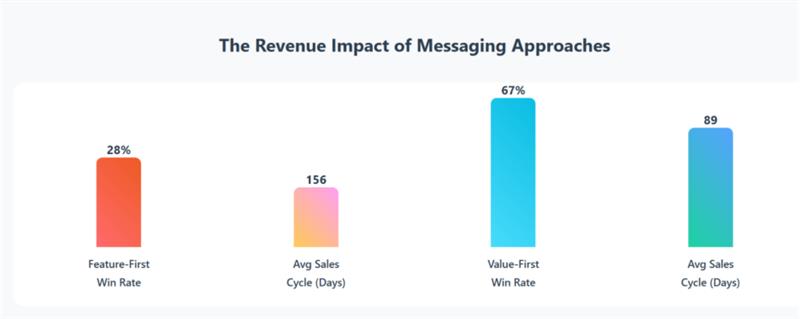

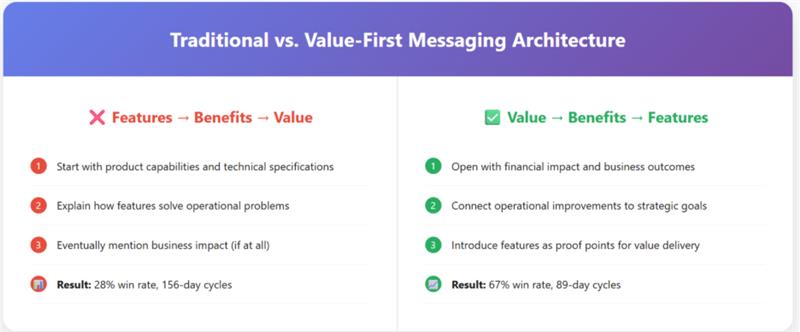

Messaging Frameworks: From FBV to VBF

The sequence of your conversation determines buyer engagement. Leading with value transforms everything.

Why This Works?

Value-first messaging pre-qualifies buyer attention. If they don’t care about the outcome, they won’t care about the future.

How to Flip the Sequence So “Value” Leads Every Conversation?

The 3-2-1 Value Opening:

- 3 seconds: Lead with quantified business impact

- 2 minutes: Connect impact to their specific situation

- 1 question: “Does this magnitude of improvement warrant a deeper conversation?”

–> Example Value Opening: “Based on companies similar to yours, we typically see $4.7M in annual cost avoidance through supply chain optimization. Given your current volume of 230,000 units quarterly, you could be looking at 67% cycle time reduction and $890K in working capital recovery. Does this level of operational improvement align with your 2025 priorities?”

What CFOs, COOs, and CEOs Actually Pay Attention To?

Each C-level role has distinct priorities and evaluation criteria. Master these frameworks to unlock executive access and accelerate deal velocity.

| CFO Financial Metrics | COO Operational Metrics | CEO Strategic Metrics |

|---|---|---|

| Primary Focus Areas: • ROI & IRR: Investments must clear 18–25% hurdle rates • Payback Period: Typically 12–18 months maximum • Cash Flow Impact: Working capital and operational cash flow effects • Risk Mitigation: Compliance, audit, and financial control improvements | Primary Focus Areas: • Productivity Gains: Output per FTE and resource optimization • Cost Avoidance: Preventing operational inefficiencies and waste • Cycle Time Reduction: Process acceleration and throughput improvement • Quality Metrics: Error reduction and consistency improvements | Primary Focus Areas: • Market Share Growth: Competitive positioning and market penetration • Risk Mitigation: Regulatory, operational, and strategic risk reduction • Valuation Impact: EBITDA multiple expansion and enterprise value • Strategic Differentiation: Sustainable competitive advantages |

The Psychology of Value Messaging: Why Mindset Shapes Outcomes

Elite sales performers don’t just use different words—they fundamentally approach conversations with a different strategic mindset.

| From “Convince” to “Qualify Fast” | From “Pitching” to “Mapping” | From “Persisting” to “Pattern-Breaking” |

|---|---|---|

| Stop trying to convince skeptical buyers. Instead, quickly identify executives who have the budget, authority, and timeline to invest in solutions that deliver measurable business value. | Replace generic product pitches with strategic discovery that maps specific pain points to quantifiable business outcomes. Great reps uncover problems worth solving before presenting solutions. | Shift from persistent follow-up to pattern interruption. Create compelling urgency through business case development that makes inaction more expensive than action. |

Common Messaging Pitfalls That Drive Deals Down

These systematic mistakes cost companies millions in lost opportunities—yet they’re completely preventable with proper training and frameworks.

| Over-Indexing on Features | One-Size-Fits-All Messaging | Generic ROI Claims | Late-Stage Financial Logic |

|---|---|---|---|

| Leading with product capabilities instead of business outcomes. When reps spend 73% of conversation time on features, buyers struggle to build internal business cases and deals stall in committee review. | Using identical value propositions for CFOs and end-users. Each stakeholder evaluates different metrics—financial, operational, or strategic—requiring tailored messaging frameworks. | Presenting industry-average returns without customer-specific calculations. CFOs approve investments based on their unique financial models, not generic case studies. | Waiting until procurement to introduce financial justification. Business value must be established early in the buying process to secure executive sponsorship and budget approval. |

Case Example: How a Health Equipment Manufacturer Engineered 8X ROI in Retention & Growth

A $60–80M post-acute division facing stalled growth and rising churn reversed its trajectory by building a systems-driven customer success model.

| BEFORE: Fragmented Retention Approach | AFTER: Strategic Retention & Revenue Acceleration |

|---|---|

| 15% annual churn with revenue leakage across ghost accounts | Data-driven risk model flagged 200+ at-risk accounts proactively |

| Disconnected teams operating in silos without accountability | SWAT response teams deployed with role-specific playbooks and account guardians |

| Weak engagement processes leading to low customer stickiness | Reactivation campaigns re-engaged ghost accounts and rebuilt trust |

| Pipeline stagnation and poor visibility into at-risk accounts | Real-time alerts and faster support created measurable lift in customer confidence |

Impact Delivered

| $5M+ Pipeline Created | $4M+ New Revenue Generated | $1.2M Churn Recovered | 8X Return on Investment |

|---|

Strategic Improvements Implemented

| Risk Identification Engine | SWAT Playbooks & Guardians | Reactivation Campaigns | Real-Time Alert Systems |

|---|---|---|---|

| Data analytics surfaced 200+ at-risk accounts before churn events. | Specialized teams with structured engagement frameworks reduced silos and raised accountability. | Targeted outreach rebuilt relationships with ghost accounts and re-ignited dormant revenue. | Enabled proactive support and intervention, cutting resolution time and boosting retention confidence. |

Outcome:

The division unlocked $27M in total value creation through pipeline acceleration, churn recovery, and sustained account retention. By transforming fragmented engagement into a scalable, systems-driven customer success model, leadership achieved 8X ROI and positioned the business for long-term resilience.

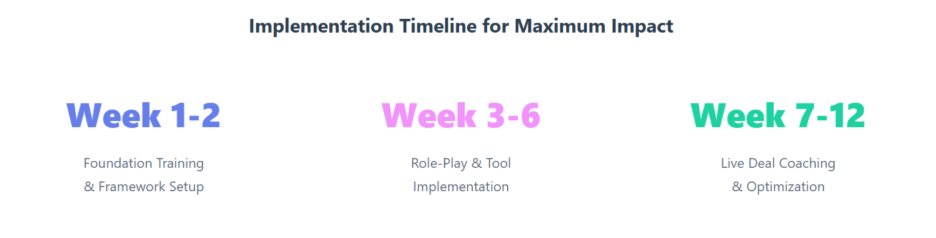

Building a Value-Messaging Ready Team: Checklist for Sales Leaders

Systematic capability development across four critical dimensions that drive measurable revenue impact. This comprehensive Business-Value Messaging Training for Sales Teams approach ensures sustainable transformation.

| Financial Fluency | Operational Mapping | Strategic Positioning | Enablement Infrastructure |

|---|---|---|---|

| ✓ Reps fluent in ROI, IRR, and payback period calculations | ✓ Clear mapping of product capabilities to workflow efficiency gains | ✓ ICP-specific playbooks with outcome-based value propositions | ✓ Rebuttal libraries for common objections by buyer persona |

| ✓ Understanding of EBITDA impact and margin improvement metrics | ✓ Understanding of operational pain points by role and department | ✓ Competitive differentiation tied to business impact metrics | ✓ ROI calculators and business case development tools |

| ✓ Ability to articulate cash flow implications and working capital effects | ✓ Quantification of productivity improvements and cost avoidance | ✓ Strategic narrative connecting solutions to market trends | ✓ Real-time coaching feedback on value messaging quality |

| ✓ Knowledge of customer financial models and budget cycles | ✓ Process optimization stories with measurable before/after metrics | ✓ Executive-level conversation frameworks and meeting agendas | ✓ Performance dashboards tracking value-messaging adoption |

Selling Smart vs. Selling More

The most successful sales organizations don’t just increase activity—they transform the quality of every buyer interaction through strategic value messaging.

Why Timing, Preparation, and Value Framing Matter More Than Product Features?

| Strategic Timing | Deep Preparation | Value Framing |

|---|---|---|

| Elite reps sell when buyers have budget, urgency, and executive sponsorship—not when products are ready. | Every conversation backed by financial research, competitive intelligence, and stakeholder mapping. | Positioning solutions as strategic investments that deliver measurable business outcomes. |

“The real question isn’t how do we pitch better, but how do we prove business value faster?”

When sales teams master business-value messaging, everything accelerates: deal velocity, win rates, average contract values, and competitive displacement.

Run a Value-Messaging Audit for Your Sales Team

In one strategic session, discover exactly where your team’s messaging creates value—and where millions in revenue opportunity is being left on the table.