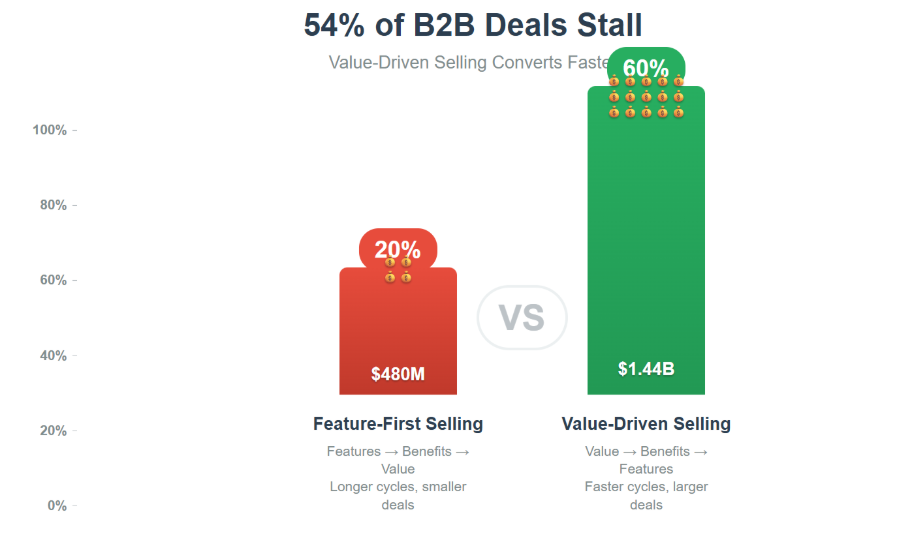

The $2.7 trillion B2B sales industry has a dirty secret: 73% of deals are lost not because of price, competition, or product limitations—but because buyers can’t quantify the business value of saying “yes.” The fundamental gap between product-driven selling and value-driven selling conversations costs companies millions in lost revenue opportunities.

The companies breaking through aren’t just closing deals faster—they’re capturing market share during critical adoption windows, improving cash flow predictability, and delivering higher returns to stakeholders who demand both growth and efficiency.

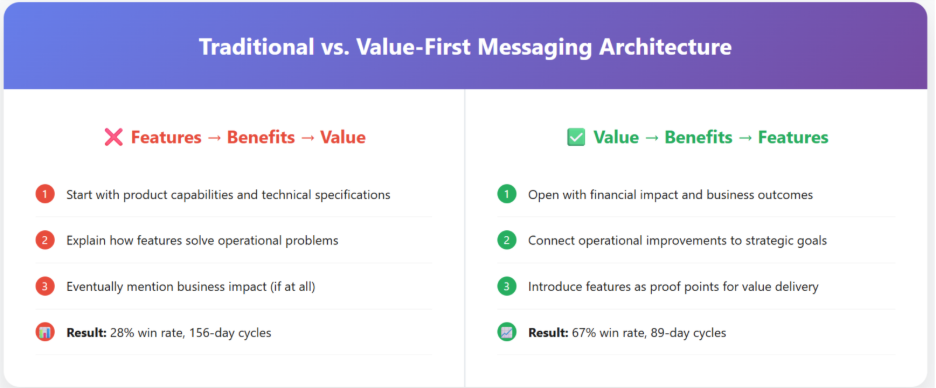

Recent analysis of 12,000+ sales conversations across SaaS, manufacturing, and professional services reveals a shocking pattern: The average B2B rep spends 67% of discovery calls talking about what their product does, and only 11% connecting it to measurable business outcomes.

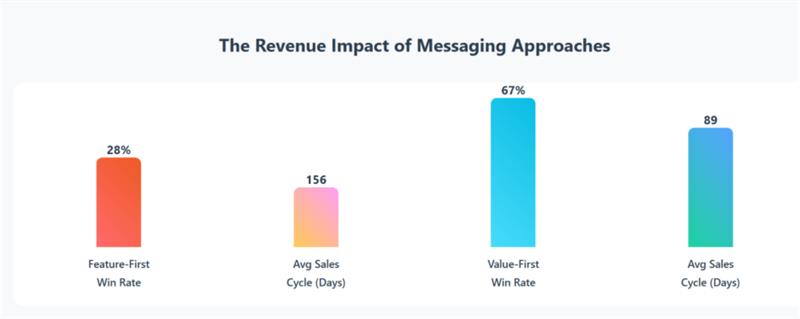

Here’s what makes this data even more alarming: When we reverse-engineered closed-won deals worth $50M+ annually, we discovered that winning reps don’t pitch better—they sequence conversations differently. They lead with quantified business impact, not product capabilities.

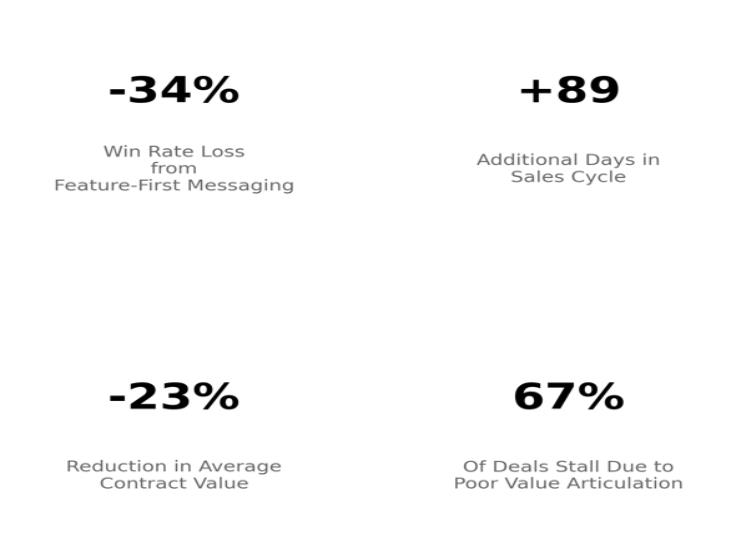

Every quarter, feature-focused sales approaches systematically drain revenue through missed opportunities, extended cycles, and competitive vulnerabilities. The traditional sales conversation follows a predictable death spiral:

The modern B2B buying journey has fundamentally shifted from evaluating products to evaluating investments. Yet most sales organizations remain trapped in feature-benefit-value sequences that mirror 1990s selling methodologies. This disconnect manifests in three critical ways:

The root cause isn’t skill deficiency, it’s systematic misalignment between how sales teams are trained and how modern buyers actually make decisions. The average ROI of B2B sales training is an impressive 353%, yet most training programs focus on product knowledge and presentation skills rather than financial acumen and outcome mapping.

| Missed C-Suite Opportunities | Extended Sales Cycles | Smaller Deal Sizes |

|---|---|---|

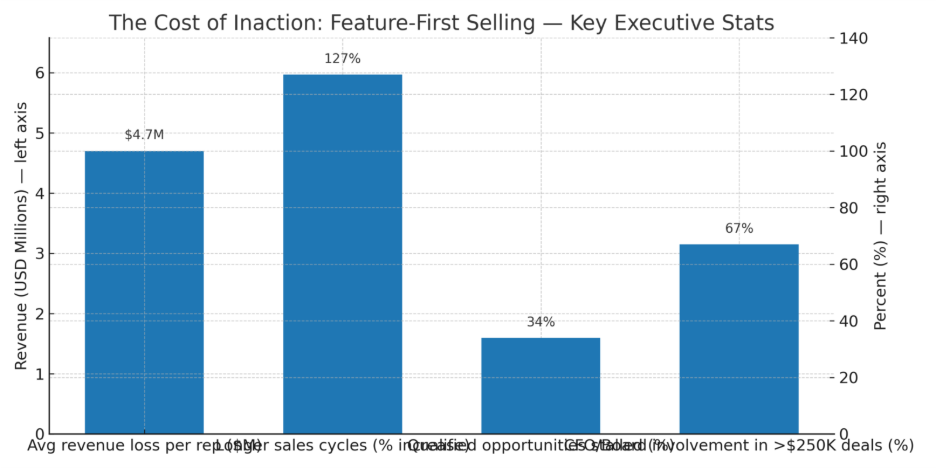

| When reps can’t connect product capabilities to CFO/CEO priorities like EBITDA impact, cost reduction, or risk mitigation, 68% of executive conversations end without follow-up meetings. | Feature-driven conversations create 127% longer sales cycles as prospects struggle to build internal business cases, leading to competitive displacement and deal fatigue. | Without clear ROI articulation, buyers default to minimal viable purchases instead of strategic platform investments, reducing average contract values by 23–41%. |

Extended sales cycles don’t just delay revenue—they compound opportunity costs across multiple dimensions that most MedTech executives significantly underestimate.

In deals over $250K, 67% of final decisions involve CFOs or board-level executives. Yet most reps never speak their language.

CFOs don’t care that your software has “advanced reporting capabilities.” They care that it can reduce the monthly closing time from 12 days to 4 days, freeing up $890K in working capital annually.

The data is brutal:

| Financial Fluency | Operational Mapping | Strategic Positioning | Enablement Infrastructure |

|---|---|---|---|

| Reps fluent in ROI, IRR, and payback period calculations | Clear mapping of product capabilities to workflow efficiency gains | ICP-specific playbooks with outcome-based value propositions | Rebuttal libraries for common objections by buyer persona |

| Understanding of EBITDA impact and margin improvement metrics | Understanding of operational pain points by role and department | Competitive differentiation tied to business impact metrics | ROI calculators and business case development tools |

| Ability to articulate cash flow implications and working capital effects | Quantification of productivity improvements and cost avoidance | Strategic narrative connecting solutions to market trends | Real-time coaching feedback on value messaging quality |

| Knowledge of customer financial models and budget cycles | Process optimization stories with measurable before/after metrics | Executive-level conversation frameworks and meeting agendas | Performance dashboards tracking value-messaging adoption |

Fact: The longer you wait to introduce business value, the more expensive your silence becomes.

Rational View: Poor value messaging costs the average B2B company $47M annually in recoverable revenue.

Revenue Leakage from Longer Cycles, Smaller Deal Sizes, and Higher Churn

Elite sales teams structure every conversation around these three value dimensions that buyers care about and remember. This is where effective Business-Value Messaging Training for Sales Teams becomes critical for sustainable revenue growth.

| Financial Alignment | Operational Relevance | Strategic Resonance |

|---|---|---|

| Speaking in ROI, Payback, and EBITDA Impact: Transform product capabilities into measurable financial outcomes. CFOs approve investments that demonstrate a clear IRR above cost of capital, typically 18-25% minimum thresholds. | Tailoring to Workflow and Process Pain: Connect solutions to specific operational inefficiencies that COOs prioritize cycle time reduction, quality improvements, and resource optimization that drives productivity gains. | Connecting to Growth and Competitive Positioning: Align with CEO-level priorities around market share expansion, risk mitigation, and strategic differentiation that impacts enterprise valuation multiples. |

Why This Works?

Value-first messaging pre-qualifies buyer attention. If they don’t care about the outcome, they won’t care about the future.

The 3-2-1 Value Opening:

Example Value Opening: “Based on companies similar to yours, we typically see $4.7M in annual cost avoidance through supply chain optimization. Given your current volume of 230,000 units quarterly, you could be looking at 67% cycle time reduction and $890K in working capital recovery. Does this level of operational improvement align with your 2025 priorities?”

| CFO – Financial Metrics | COO – Operational Metrics | CEO – Strategic Metrics |

|---|---|---|

Primary Focus Areas:

|

Primary Focus Areas:

|

Primary Focus Areas:

|

| From “Convince” to “Qualify Fast” | From “Pitching” to “Mapping” | From “Persisting” to “Pattern-Breaking” |

|---|---|---|

| Stop trying to convince skeptical buyers. Instead, quickly identify executives who have the budget, authority, and timeline to invest in solutions that deliver measurable business value. | Replace generic product pitches with strategic discovery that maps specific pain points to quantifiable business outcomes. Great reps uncover problems worth solving before presenting solutions. | Shift from persistent follow-up to pattern interruption. Create compelling urgency through business case development that makes inaction more expensive than action. |

| Impact Delivered | |

|---|---|

| $5M+ Pipeline Created | $4M+ New Revenue Generated |

| $1.2M Churn Recovered | 8X Return on Investment |

| Strategic Improvements Implemented | Description |

|---|---|

| Risk Identification Engine | Data analytics surfaced 200+ at-risk accounts before churn events. |

| SWAT Playbooks & Guardians | Specialized teams with structured engagement frameworks reduced silos and raised accountability. |

| Reactivation Campaigns | Targeted outreach rebuilt relationships with ghost accounts and re-ignited dormant revenue. |

| Real-Time Alert Systems | Enabled proactive support and intervention, cutting resolution time and boosting retention confidence. |

| Outcome |

|---|

| The division unlocked $27M in total value creation through pipeline acceleration, churn recovery, and sustained account retention. By transforming fragmented engagement into a scalable, systems-driven customer success model, leadership achieved 8X ROI and positioned the business for long-term resilience. |

Systematic capability development across four critical dimensions that drive measurable revenue impact. This comprehensive Business-Value Messaging Training for Sales Teams approach ensures sustainable transformation.

| Financial Fluency | Operational Mapping | Strategic Positioning | Enablement Infrastructure |

|---|---|---|---|

| Reps fluent in ROI, IRR, and payback period calculations | Clear mapping of product capabilities to workflow efficiency gains | ICP-specific playbooks with outcome-based value propositions | Rebuttal libraries for common objections by buyer persona |

| Understanding of EBITDA impact and margin improvement metrics | Understanding of operational pain points by role and department | Competitive differentiation tied to business impact metrics | ROI calculators and business case development tools |

| Ability to articulate cash flow implications and working capital effects | Quantification of productivity improvements and cost avoidance | Strategic narrative connecting solutions to market trends | Real-time coaching feedback on value messaging quality |

| Knowledge of customer financial models and budget cycles | Process optimization stories with measurable before/after metrics | Executive-level conversation frameworks and meeting agendas | Performance dashboards tracking value-messaging adoption |

| Strategic Timing | Deep Preparation | Value Framing |

|---|---|---|

| Elite reps sell when buyers have budget, urgency, and executive sponsorship—not when products are ready. | Every conversation backed by financial research, competitive intelligence, and stakeholder mapping. | Positioning solutions as strategic investments that deliver measurable business outcomes. |

In one strategic session, discover exactly where your team’s messaging creates value—and where millions in revenue opportunity is being left on the table.

“The real question isn’t how do we pitch better, but how do we prove business value faster?”

When sales teams master business-value messaging, everything accelerates deal velocity, win rates, average contract values, and competitive displacement.

Don’t guess. Test.