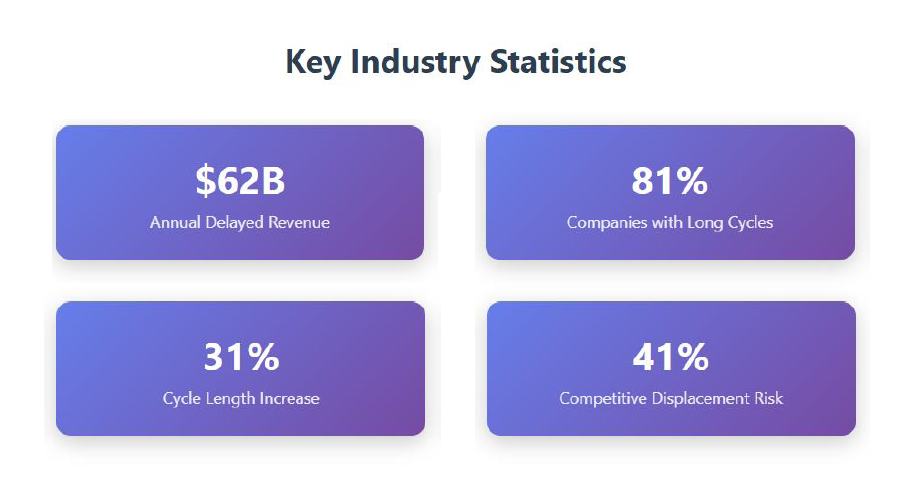

81%

of MedTech companies report sales cycles 50-70% longer than necessary, while only 12% have systematically implemented MedTech Sales Cycle Acceleration strategies that compress timelines without compromising deal quality.

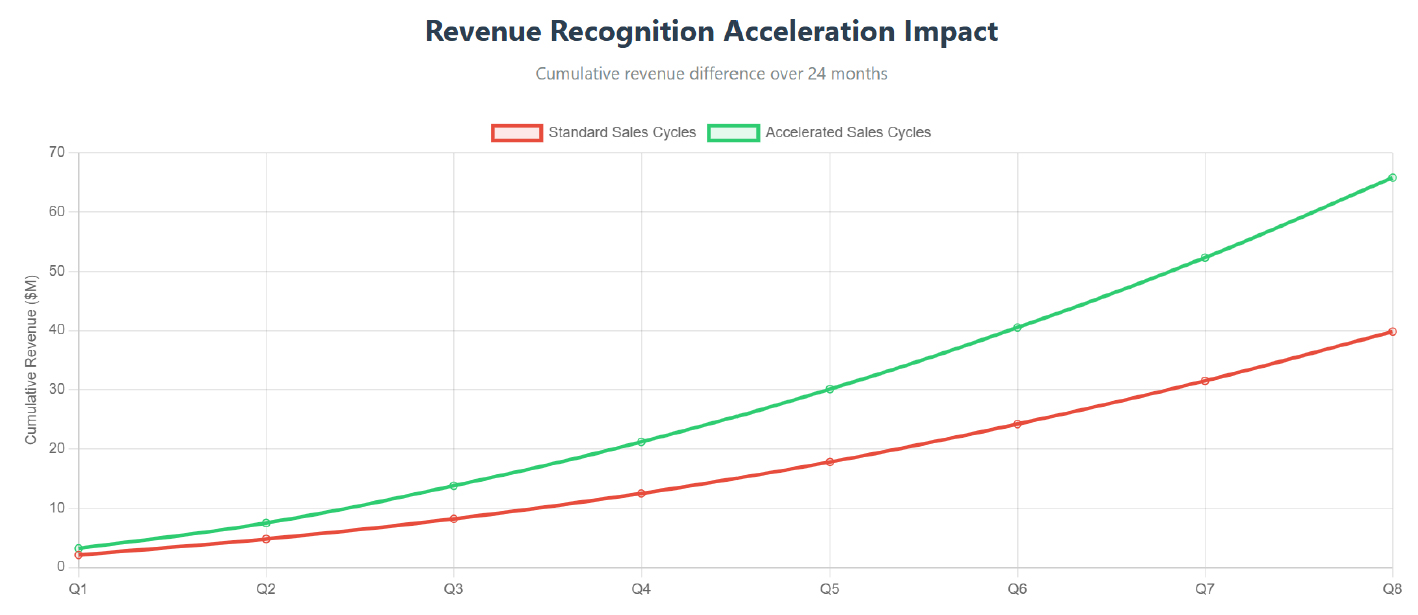

Yet the average MedTech sales cycle has actually lengthened by 31% over the past five years, according to recent industry analysis. This isn’t a market problem—it’s a process problem.

The companies achieving MedTech Sales Cycle Acceleration understand that speed isn’t about pressure—it’s about precision. They’ve rebuilt their sales processes around buyer urgency, decision-making psychology, and value realization timelines that align with modern healthcare procurement.

Impact Analysis:

Critical Threshold: Analysis shows that deals extending beyond 16 months face a 41% higher risk of competitive displacement, regardless of product superiority.

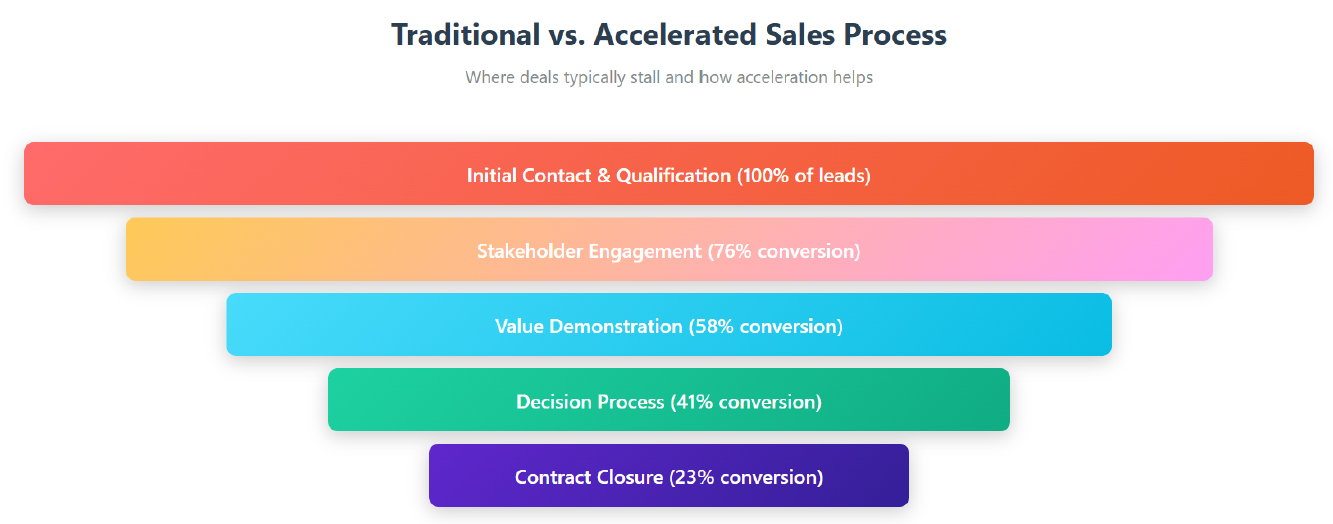

MedTech sales cycles stall at predictable inflection points that haven’t been systematically addressed by most organizations. Understanding these breakdown patterns is essential for implementing effective healthcare sales optimization and revenue acceleration strategies.

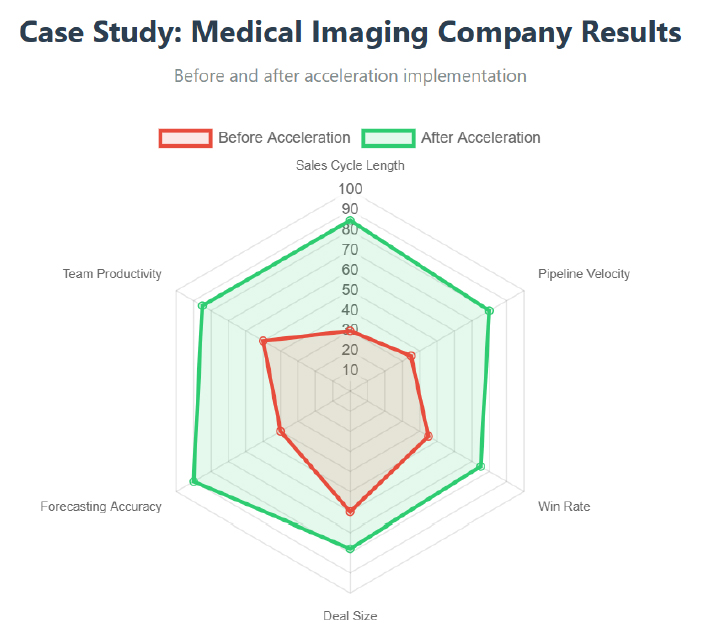

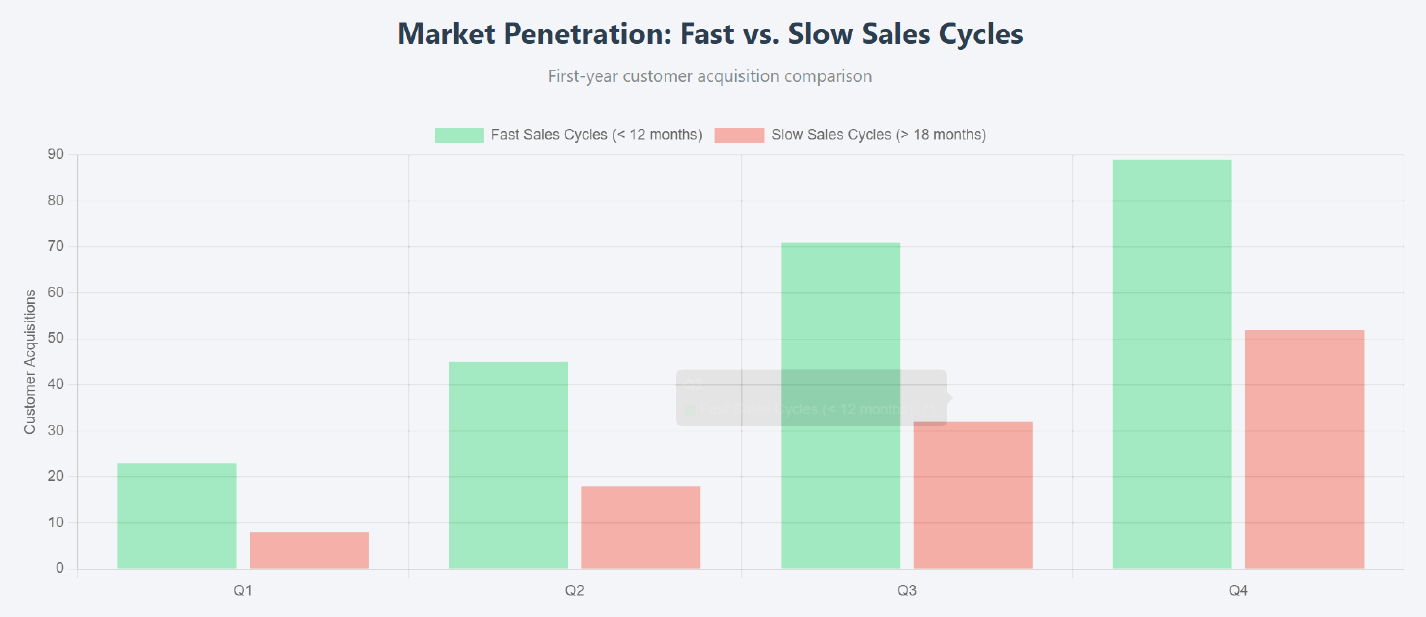

Systematic MedTech Sales Cycle Acceleration requires strategic interventions at each breakdown point. Companies achieving sub-12-month cycles deploy these levers in coordinated sequences rather than isolated tactics.

Value-Based Messaging Framework

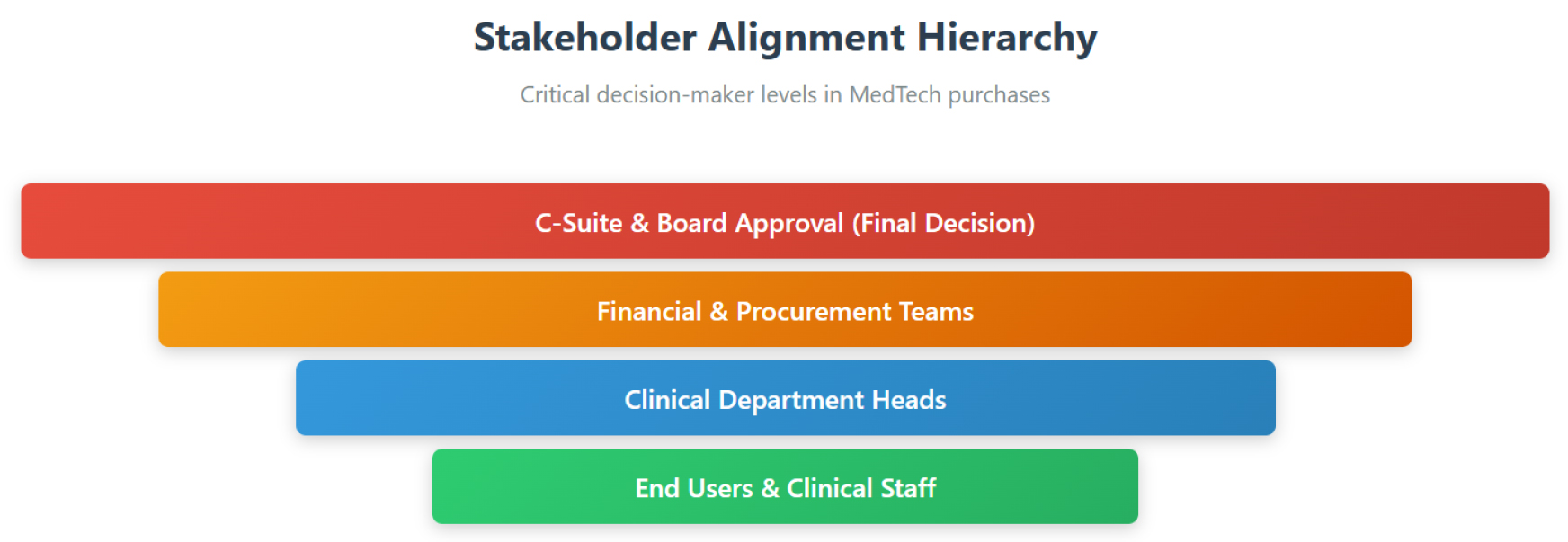

Implementation: Develop messaging hierarchies that address clinical, financial, and operational stakeholders simultaneously rather than sequentially.

Result: Compressed stakeholder alignment from 7-11 months to 4-5 months through systematic orchestration.

Impact: 29% reduction in average sales cycles through systematic process optimization and proactive buyer support.

Core Components:

Outcome: Transform regulatory discussions from obstacles into competitive advantages through superior preparation and support.

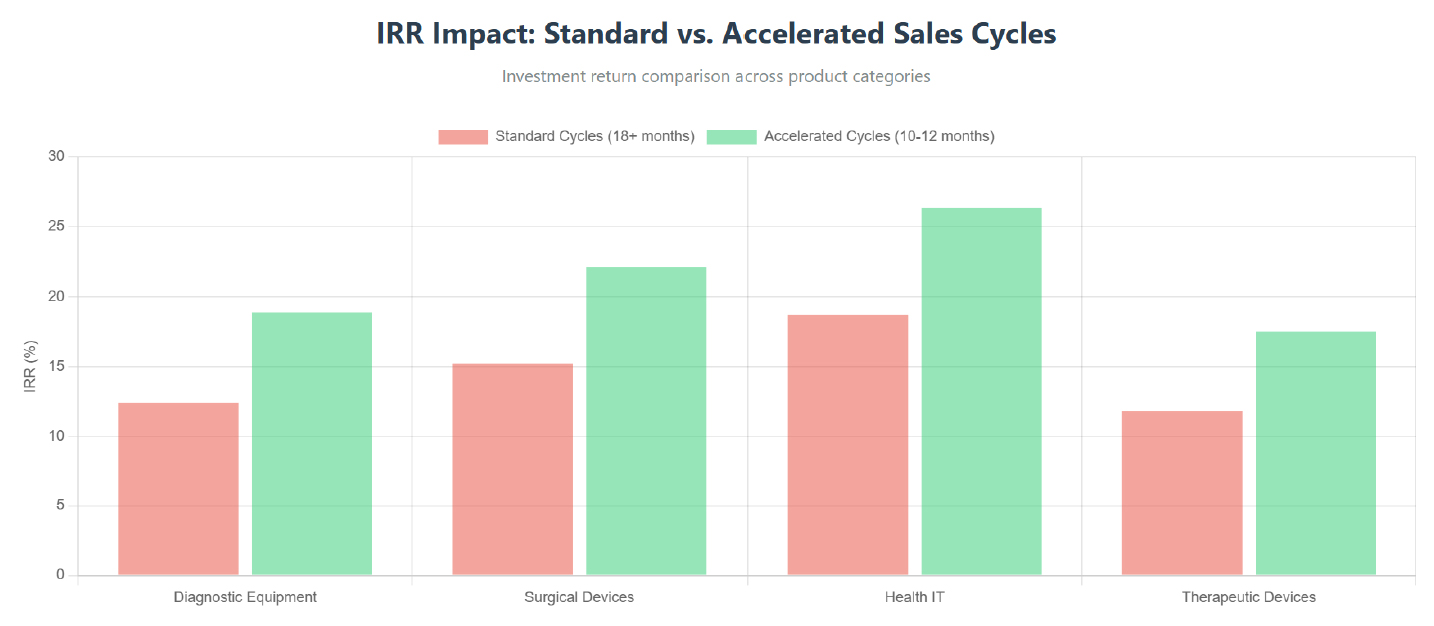

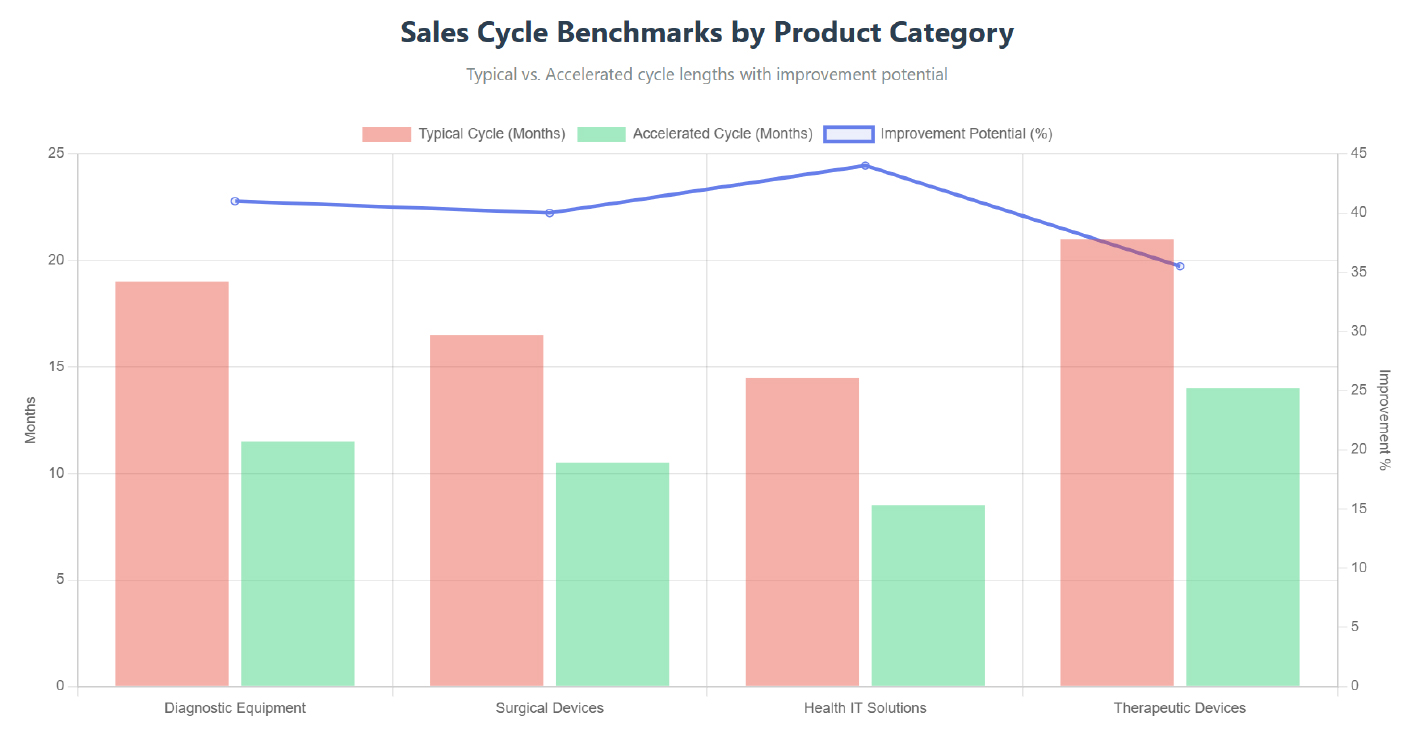

| Product Category | Typical Cycle | Accelerated Cycle | Improvement Potential |

|---|---|---|---|

| Diagnostic Equipment | 16–22 months | 10–13 months | 37–45% reduction |

| Surgical Devices | 14–19 months | 9–12 months | 38–42% reduction |

| Health IT Solutions | 12–17 months | 7–10 months | 42–47% reduction |

| Therapeutic Devices | 18–24 months | 12–16 months | 33–38% reduction |

Phase 2: SWAT Team Deployment (Months 3–4)

Phase 3: Churn-Proof System Activation (Months 5–8)

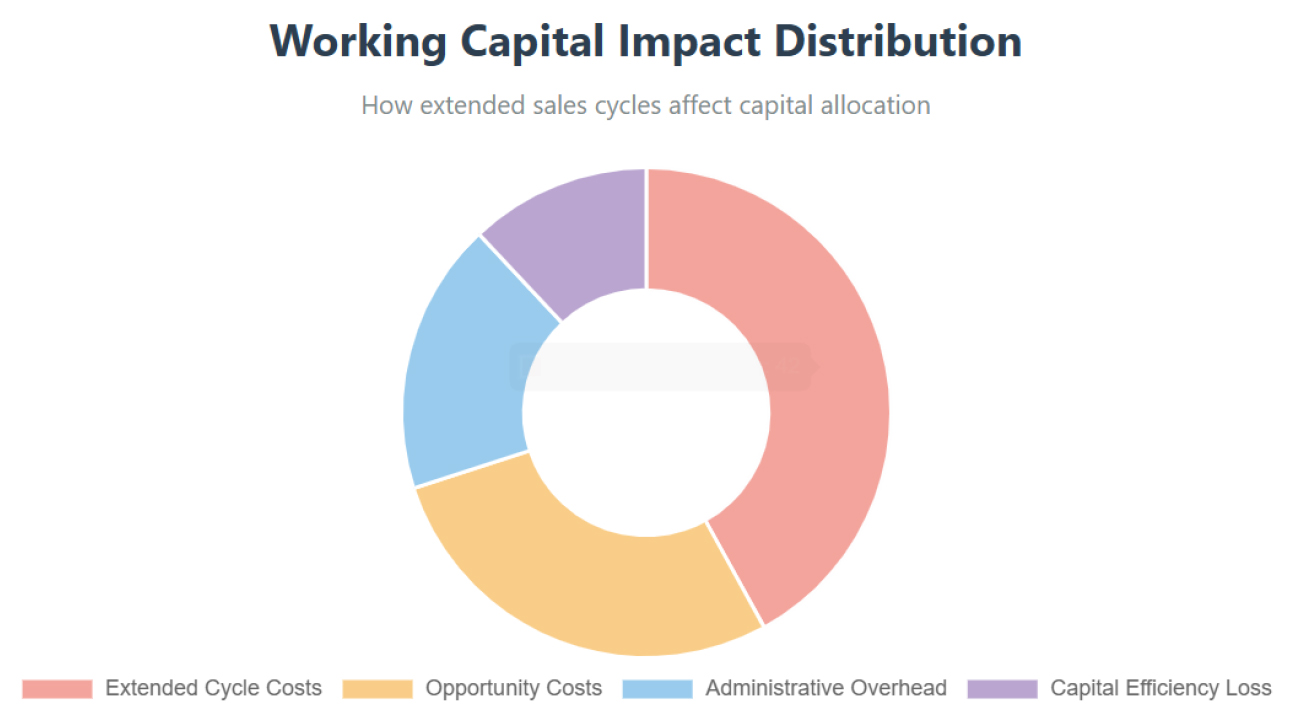

Building sustainable healthcare sales optimization and revenue acceleration requires systematic process design that supports both speed and quality outcomes.

Rapid Qualification & Stakeholder Mapping (Weeks 1-4)

Key Performance Indicators:

Continuous Improvement Framework:

MedTech Sales Cycle Acceleration isn’t about rushing buyers or compromising deal quality. It’s about systematic process optimization that aligns with modern healthcare procurement realities and decision-making psychology.

Don’t guess. Test.