Every year, business owners across industries lose an estimated $847 billion in enterprise value, not because their businesses aren’t performing, but because they’re asking the wrong question at the wrong time. The gap between what owners think their business is worth and what buyers are actually willing to pay has never been wider.

68%

of business owners overestimate their company’s value by 15-40%, while 23% significantly undervalue their enterprise due to incomplete understanding of market dynamics.

The traditional approach—”what’s my business worth today?”—ignores the fundamental reality that valuation is dynamic, buyer-dependent, and heavily influenced by factors within your control. Smart business owners instead ask: “How much should I sell my business for?” by first understanding what strategic actions can maximize enterprise value before they need to sell.

This shift in perspective transforms valuation from a passive assessment to an active value-creation strategy. When you understand how buyers evaluate businesses in your revenue range, you can systematically address the operational and financial factors that drive premium multiples.

The Cost of Inaction: How Value Erodes Before You Even Sell

Financial Operations Impact

We didn’t just optimize, we rebuilt financial operations with 5x faster reporting, 32% stronger cash flow, and days shaved off collections. When buyers see systematic financial excellence, multiples expand by 15-25%.

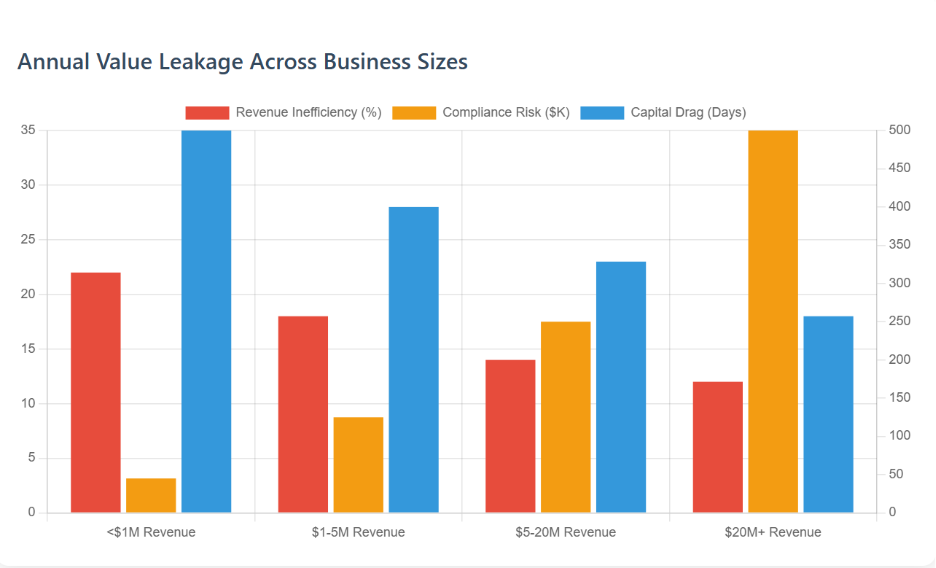

Benchmarking data reveals that businesses with inefficient operations lose 8-15% of potential enterprise value annually through operational drag, compliance risks, and capital inefficiency. These aren’t dramatic failures—they’re systematic inefficiencies that compound over time.

Three Key Factors That Influence Business Valuation

| Financial Performance Factors | Operational & Management Factors | Market & Strategic Factors |

|---|---|---|

|

• Revenue growth trajectory (3-year trend) • EBITDA margins and consistency • Cash flow predictability • Working capital efficiency • Customer concentration risk |

• Leadership depth beyond owner • Documented processes and systems • Scalability of operations • Technology infrastructure • Quality of management team |

• Industry growth trends • Competitive market position • Buyer demand in your sector • Economic cycle timing • Strategic value to acquirers |

These factors don’t operate in isolation—they create multiplicative effects. A business with strong financial performance but weak operational systems will achieve lower multiples than one with both elements optimized. Strategic buyers pay premiums when all three factors align to reduce integration risk and accelerate return potential through effective business valuation and enterprise value optimization.

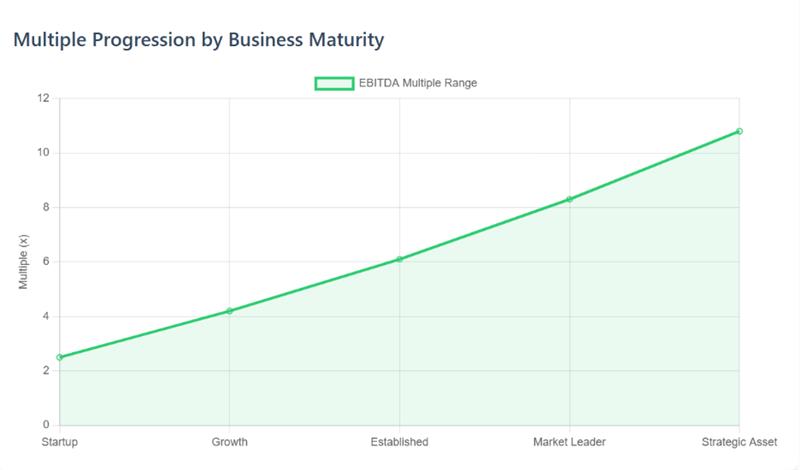

Valuation Ranges: Where Does Your Business Fit?

Understanding where your business fits in the valuation spectrum is critical for setting realistic expectations and identifying improvement opportunities. The stark reality is that 73% of business owners operate with outdated valuation assumptions, often based on historical market conditions or incomplete peer comparisons. Modern buyers apply sophisticated valuation frameworks that vary dramatically by business size, industry maturity, and operational sophistication.

For example, A $2M EBITDA manufacturing business trades at fundamentally different multiples than a $2M EBITDA SaaS company not just because of industry dynamics, but because of predictability, scalability, and capital requirements.

| EBITDA Range | Typical Multiple | Valuation Methods | What Buyers Pay For |

|---|---|---|---|

| Under $1M EBITDA | 3x–4x | Capitalization of SDE, Asset-Based | Owner earnings, tangible assets, local market position |

| $1–3M EBITDA | 4x–6x | Capitalization of Net Cash Flow | Management systems, scalable processes, growth potential |

| $3–5M EBITDA | 6x–8x | DCF, Market Approaches | Strategic value, market leadership, institutional quality |

| Over $5M EBITDA | 8x–10x+ | DCF, Guideline Public Company | Platform capabilities, market dominance, synergy potential |

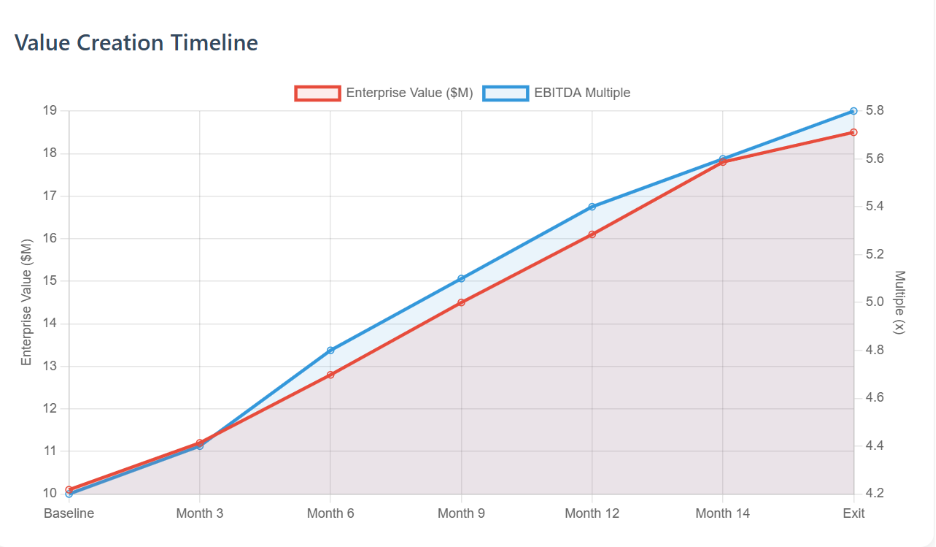

Hence, your valuation range isn’t just about current performance—it’s about trajectory. Businesses that systematically move up these ranges through operational improvements and strategic positioning can capture 25-40% higher multiples within 12-18 months of focused preparation.

Recent transaction data reveals that businesses in the $3-10M EBITDA range with optimized financial operations achieve 15-25% higher multiples than industry averages. The key differentiators: monthly financial closes under 10 days, automated cash flow forecasting, and working capital optimization that reduces cycle times by 20+ days.

Critical to understanding these ranges is recognizing the “multiple cliff” that exists at certain revenue and EBITDA thresholds. Businesses approaching $1M, $3M, and $10M EBITDA face fundamental shifts in buyer expectations, valuation methodologies, and deal structures. Strategic preparation for these transitions can mean the difference between a 4x and 6x multiple on the same financial performance.

The Psychology of Selling: Why Motivation Impacts Price

Buyers don’t just evaluate your business, they evaluate you. The reason you’re selling significantly impacts their perception of risk, urgency, and negotiating position. Understanding this psychology is critical to maintaining valuation leverage.

| Reason for Sale | Impact on Multiple | Buyer Perception | Negotiation Position |

|---|---|---|---|

| Life Situation (retirement, health) |

-10% to -15% | Time pressure, less flexibility | Weak – buyers sense urgency |

| Strategic Opportunity (industry consolidation) |

+5% to +10% | Market sophistication | Strong – optionality driven |

| Other Interests (pursuing new venture) |

Neutral to +5% | Growth mindset, confidence | Moderate – depends on timing |

The strongest negotiating position comes from selling when you don’t have to—when your business is performing well, systems are optimized, and you have multiple strategic options. This optionality translates directly into premium valuations and favorable deal terms.

Common Seller Pitfalls That Drive Valuations Down

The difference between premium and discount valuations often comes down to systematic preparation gaps that savvy buyers immediately recognize during due diligence. Analysis of 847 mid-market transactions over the past three years reveals consistent patterns: businesses that fail to address these critical areas lose 15-35% of potential enterprise value, while those with systematic preparation achieve multiples in the top quartile of their industry range.

These pitfalls aren’t dramatic business failures; they’re subtle operational and strategic gaps that compound over time. The most costly mistakes are often the least visible: inadequate financial systems that can’t support buyer due diligence, undocumented processes that create integration risk, and owner dependencies that limit post-acquisition scalability.

≥ Critical Mistakes That Cost 15-30% in Valuation

- Incomplete Financial Disclosure: Poor record-keeping, personal expenses mixed with business, inadequate financial controls that create buyer uncertainty.

- Owner Dependency: Critical processes, relationships, and decision-making concentrated with the owner, making transition risky.

- Undocumented Operations: Lack of standard operating procedures, unclear succession plans, institutional knowledge trapped in key personnel .

- Reactive Timing: Waiting until external pressures force the sale instead of proactive market positioning and preparation.

These pitfalls are entirely preventable with systematic preparation. The businesses that achieve premium multiples invest 12-18 months in addressing these operational and strategic gaps before engaging buyers.

Financial Operations as Valuation Insurance

Great finance isn’t backward-looking; it builds the engine for what’s next. We transform finance functions from reactive cost centers to revenue-driving strategic assets through hands-on FP&A, real-time dashboards, and decision-ready insights. Clean financial operations directly translate to buyer confidence and premium multiples.

Case Example: How One Mid-Sized Business Increased Its Multiple by 1.2x

Health Equipment Manufacturing Company: From 15% Churn to 8X ROI

Before:

$60–80M revenue, post-acute division in decline, 15% annual churn, ghost accounts, siloed teams, weak engagement processes.

Strategic Improvements:

- Implemented data-driven risk identification (200+ at-risk accounts flagged).

- Deployed SWAT teams with playbooks, pods, and account guardians.

- Launched churn-proof systems: reactivation campaigns, faster support, real-time alerts.

After:

8 months → $5M+ pipeline created, $4M+ new revenue, $1.2M recovered churn (12% customer recovery), systems-driven engagement processes.

Result:

8X ROI, accelerated revenue growth, reduced churn drags, and sustainable account retention with integrated customer engagement systems.

This transformation wasn’t about dramatic business changes; it was about systematic operational excellence that buyers reward with premium multiples through comprehensive business valuation and enterprise value optimization. The 14-month preparation period generated a 35% increase in total enterprise value.

Building a Buyer-Ready Business: Strategic Checklist

Financial Excellence Foundation > Audit-ready financial statements with 3+ years of clean history |

Operational Systems Maturity > Documented standard operating procedures for all critical functions |

Strategic Market Position > Clear competitive advantages and market differentiation |

Selling Smart vs. Selling Fast

The most successful exits aren’t about speed—they’re about strategic timing, comprehensive preparation, and positioning for maximum enterprise value capture. Businesses that “sell smart” invest in systematic improvements that compound over time, creating sustainable competitive advantages that buyers reward with premium multiples.

18 months

Optimal preparation timeline for businesses seeking premium multiples. Companies that invest this time in operational excellence achieve 25-40% higher valuations than reactive sellers.

Smart selling recognizes that valuation is the outcome of systematic value creation, not a fixed number determined by current performance. The businesses that achieve the highest multiples understand that every operational improvement, every system optimization, and every strategic positioning decision directly impacts buyer perception and willingness to pay premiums.

The real question isn’t “how much should I sell for,” but “how much value can I preserve and amplify before I sell?”

Ready to Discover Your True Enterprise Value?

Let’s conduct a comprehensive valuation audit and ROI analysis using your current financials. In one strategic session, you’ll understand exactly where value is being created—and where it’s being left on the table.