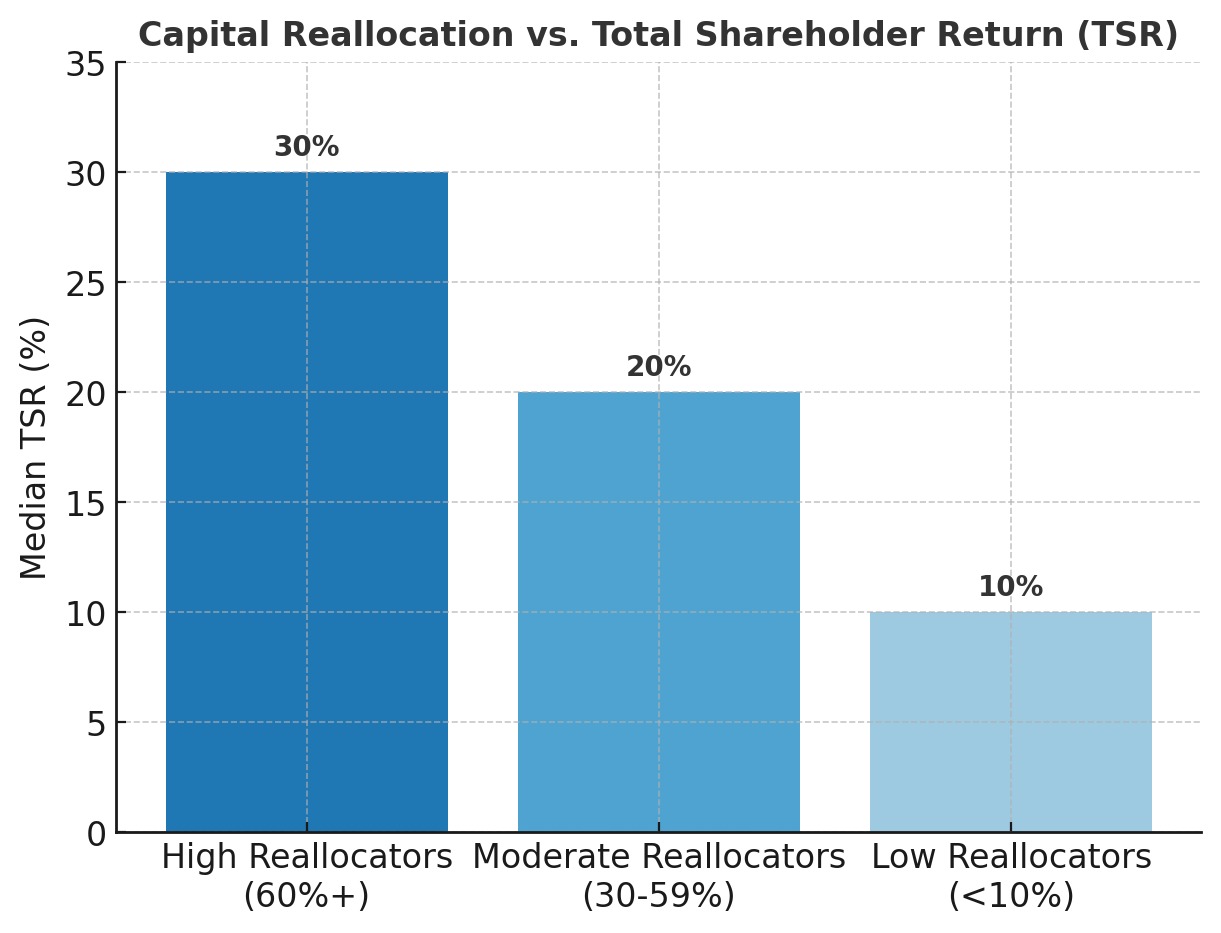

Capital Allocation Under Pressure: How CFOs Are Protecting Multiples in 2025

DATA VISUALIZATION SERIES

From volatile capital markets to margin-squeezing inflation, CFOs today are making faster, higher-stakes decisions than ever before. Based on our work with finance leaders across industries, we’ve distilled the insights shaping valuation in 2025 — the moves your peers are making to safeguard and grow enterprise value.

2 mins read

2 mins read

2 mins read

2 mins read

CAPABILITY

CAPABILITY

Don’t guess. Test.