The Brutal Truth:

“Most founders obsess over vanity metrics that acquirers ignore. You’re celebrating monthly active users while buyers are calculating customer acquisition payback periods. You’re optimizing for today’s dashboard, not tomorrow’s term sheet.”

I’ve sat in too many valuation discussions where founders confidently present growth metrics—only to watch investment bankers discount their business by 40%+ because they’re measuring the wrong things. The metrics that excite your team aren’t the metrics that drive buyer behavior. Valuation is a game of buyer psychology, not founder pride.

NextAccel 3D Valuation Intelligence Framework

DEFINE – Buyer-Centric Metrics Architecture

- Identify which metrics drive acquisition decisions in your sector

- Map your current KPIs against buyer evaluation criteria

- Establish baseline measurements for valuation-critical indicators

- Benchmark performance against recently acquired competitors

- Audit data collection systems for buyer-grade accuracy

DEPLOY – Strategic Measurement Systems

- Implement tracking infrastructure for valuation-driving metrics

- Establish reporting cadences that align with buyer evaluation cycles

- Create predictive models that forecast metric performance

- Build cross-functional accountability for metric improvement

- Design compensation structures tied to valuation-critical KPIs

DELIVER – Premium Valuation Positioning

- Optimize performance on metrics that justify premium multiples

- Position metric performance within competitive context

- Demonstrate trajectory and sustainability of key indicators

- Create narrative frameworks that highlight metric advantages

- Build acquisition-ready metric reporting for due diligence

This is valuation engineering through strategic measurement. The right metrics don’t just track performance—they drive the decisions that determine your exit multiple.

Step 1: Audit Your Metric Misalignment (Reality Check Required)

Ask your leadership team this question:

“If an acquirer evaluated us based solely on our top 5 reported metrics, would they see a premium asset or a commodity business? Which metrics would they wish we tracked instead?”

If you can’t answer with confidence, you’re measuring for the wrong audience.

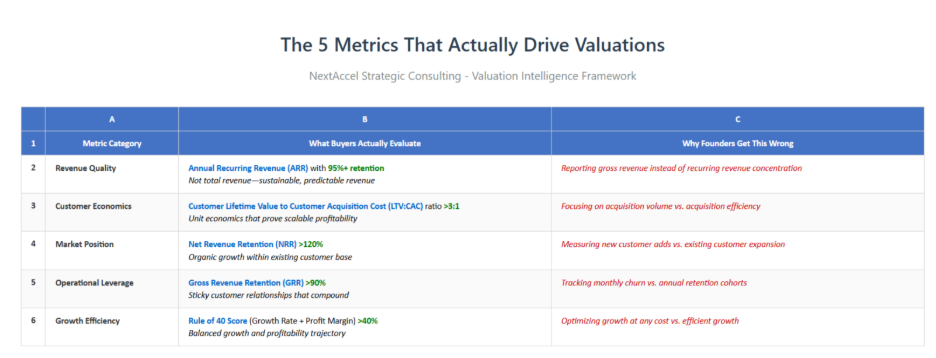

Step 2: The 5 Metrics That Actually Drive Valuations

Your diagnostic: Score your business on these 5 metrics. Anything below market benchmarks becomes your valuation improvement roadmap.

Step 3: Rebuild Your Metrics Architecture (The Valuation Optimization Process)

A. Prioritize Revenue Quality Over Revenue Quantity:

Stop celebrating: Total revenue milestones, new customer counts, or monthly recurring revenue that includes low-retention segments.

Start measuring: Annual contract values, revenue cohort retention rates, and percentage of revenue from multi-year contracts. Buyers pay premiums for predictable cash flows.

B. Demonstrate Customer Economics Mastery:

Product Strategy: Build features that increase customer lifetime value, not just user engagement. Buyers want to see expanding customer relationships.

Sales Strategy: Restructure compensation to reward high-LTV customer acquisition, not just deal closure. Track sales efficiency metrics that prove scalable growth.

Marketing Strategy: Measure marketing contribution to customer lifetime value, not just lead generation. Buyers discount businesses with unsustainable acquisition costs.

C. Build Operational Leverage Into Your Model:

Technology Infrastructure: Invest in systems that scale revenue without proportional cost increases. Buyers value operational efficiency.

Team Structure: Hire for roles that support multiple revenue streams. Demonstrate that growth doesn’t require linear headcount expansion.

Process Optimization: Document and systematize operations that impact the core 5 metrics. Buyers pay premiums for businesses that can scale without founder dependency.

Step 4: Create Valuation-Driving Metric Narratives

Run this storytelling exercise quarterly:

“If we could only present 3 metrics to justify a premium valuation, which would they be and what story do they tell about our competitive advantage?”

Premium valuation stories our clients tell:

- “Our NRR of 135% proves we’re building a compounding revenue engine”

- “Our LTV:CAC ratio of 5:1 demonstrates we’ve cracked profitable growth at scale”

- “Our Rule of 40 score improvement from 25% to 45% shows sustainable growth trajectory”

Valuation-killing stories to avoid:

- “We’re growing fast” (without profitability context)

- “We have lots of customers” (without retention data)

- “Our market is huge” (without demonstrable capture)

Step 5: Pressure-Test Your Metric Performance

I challenge clients with this scenario monthly:

“Competitor X just sold for 15x revenue with metrics similar to yours. What would make a buyer pay 20x for your business instead? What metric performance would justify that premium?”

Common valuation multipliers we optimize:

- NRR >140% can justify 20%+ valuation premiums

- GRR >95% demonstrates exceptional product-market fit

- LTV:CAC >5:1 proves you’ve built a profitable growth machine

- Rule of 40 >50% positions you in the top quartile of acquisition targets

The Strategic Outcome: Metrics That Multiply Value

Focusing on valuation-driving metrics creates compounding advantages:

Higher Multiples: Buyers pay premiums for businesses that demonstrate sustainable economics

Competitive Positioning: Superior metrics create differentiation in acquisition processes

Operational Focus: Teams align around metrics that actually drive business value

Exit Optionality: Strong metrics attract multiple buyer types and create competitive dynamics

Final Framework:

Valuation isn’t about how fast you’re growing, how many logos you’ve landed, or how great your press coverage looks.

It’s about revenue durability, operating efficiency, and predictable future cash flow streams.

The companies that win premium valuations and fast exits are the ones that engineer their operating rhythms around these 5 metrics, quarter over quarter, without exception.

“Your metrics tell the story buyers will pay for. Measure vanity, get vanity valuations. Measure value creation, get value creation multiples. The right 5 metrics can be worth 50%+ more than the wrong 50 metrics.”

Want a rapid, no-fluff valuation diagnostic?

Contact us for our 90-Minute Investor-Readiness KPI Audit.