Purpose-Built to Help MedTech CEOs Unlock Premium Pricing, Capital Efficiency & 7.5x+ Multiples.

Only 22% of MedTech startups scale beyond early commercialization due to poor sales infrastructure and operational gaps.

MedTech firms with advanced omnichannel models see 2x revenue growth vs. those with average maturity.

Only 25% of MedTech companies are on track to grow both revenue and EBITDA in the next two years.

MedTech companies using account-based marketing see up to 30% higher deal conversion vs. generic outreach strategies.

Data-Driven Breakdown of Common MedTech Bottlenecks

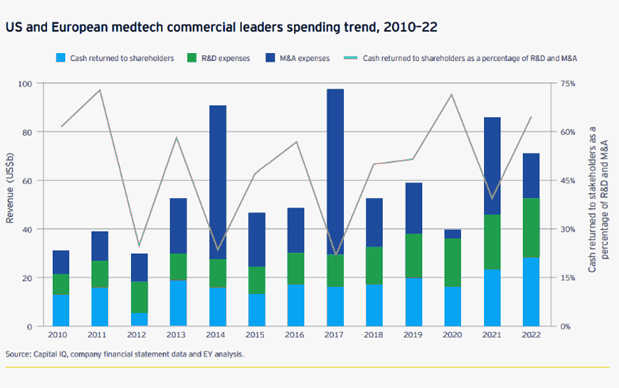

Growth is the real alpha, yet 40% of PE-backed firms fail to meet revenue growth targets post-acquisition, relying on legacy value creation methods

These outdated strategies limit scale and reduce EBITDA growth by up to 20% before real traction (Source: TBM.)

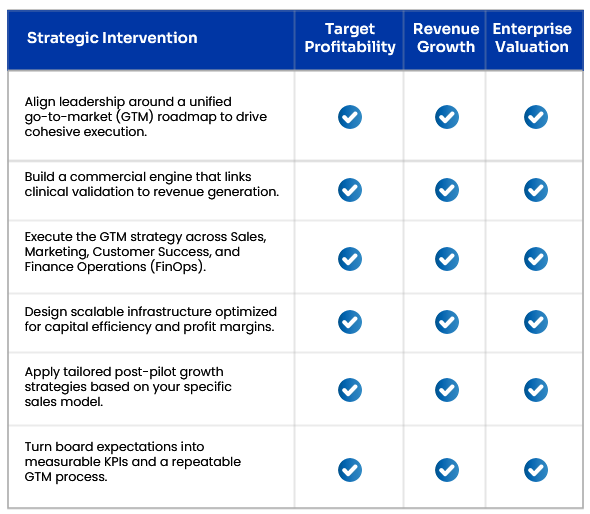

The Solution: The 3D Growth Engine

At NextAccel, we help MedTech CEOs move beyond strategy decks and into real-world execution. Our 3D Growth Engine unifies Sales, Marketing, CS, and FinOps into a single, scalable system. Purpose-built for post-Series A through pre-exit MedTech firms, it transforms clinical wins into market momentum and enterprise value.

How It Works

Align growth targets to exit thesis

Align growth targets to exit thesis

Measure market size and divide into segments

Measure market size and divide into segments

Prioritize high-margin verticals

Prioritize high-margin verticals

Map best-fit GTM models (direct vs. channel)

Map best-fit GTM models (direct vs. channel)

Stage – 2

Build repeatable GTM engines

Build repeatable GTM engines

Launch focused outbound programs

Launch focused outbound programs

Accelerate deals and revenue with AI

Accelerate deals and revenue with AI

Forecast with real-time signals

Forecast with real-time signals

Operationalize customer retention systems

Operationalize customer retention systems

Stage – 3

Optimize monetization strategies

Optimize monetization strategies

Strengthen brand market presence

Strengthen brand market presence

Position GTM as an acquisition asset

Position GTM as an acquisition asset

Maximize enterprise value to drive premium exit outcomes

Maximize enterprise value to drive premium exit outcomes

Compliance-Driven GTM

Every move comes with built-in regulatory guardrails and is aligned with FDA, HIPAA, and EU MDR standards

Clinical-Grade Credibility

Transparent execution accelerates adoption and earns trust with enterprise buyers.

Risk Containment

We flag and neutralize compliance, financial, or reputational risks before they impact value.

Regulatory Aligned Plans

Our phased GTM playbooks reduce rework and compress launch timelines.

Post regulatory clearance, we align your go-to-market strategy with business objectives, focusing on three critical data anchors: revenue potential, cost-to-acquire, and time-to-convert. Our focused 90-day acceleration plan identifies high-yield segments, validates pricing, and pressure-tests messaging with real buyers. By Month 2, you track shortened sales cycles and improved pipeline velocity. By Month 3, you possess a capital-efficient GTM engine built for repeatability and scalable growth.

Early traction matures into a disciplined growth engine. We institutionalize go-to-market rhythms, embed proven playbooks, and lock teams into predictable monthly and quarterly operating cycles. Sales, marketing, and customer success execute against a shared KPI framework: ARR, CAC, and clinical adoption, ensuring results are measurable and repeatable. Capital is allocated where it delivers the highest return, enabling revenue to scale faster than spend. The outcome: tighter forecasts, cross-functional accountability, and a go-to-market engine running like clockwork, ready for aggressive expansion or a strategic exit.

With scale established, we focus on maximizing enterprise value. We streamline cost structures, sharpen unit economics, and stress-test go-to-market performance under investor-grade scrutiny. Core metrics like LTV/CAC, NRR, and sales efficiency, are optimized, audited, and dashboarded. Strategic positioning is refined to support acquisition, IPO, or private equity diligence. The outcome: a commercialization system that’s both scalable and exit-ready, designed to withstand scrutiny from the boardroom, buy-side investors, and beyond.

return in under 8 months

in new revenue

in new sales opportunities

by reactivating lost accounts

As a serial entrepreneur & strategic advisor, Sanjeev Kalyanaraman scales companies by devising GTM strategies that maximizes enterprise value. At NextAccel, he turns growth acceleration into a finely tuned system for increased EBITDA, resulting in premium exits. His frameworks are trusted by Investors and MedTech leaders to turn commercial chaos into predictable outcomes.